No products in the cart.

Make Money Online

Is renting a waste of cash? Ramit Sethi explains

I know, I know. You have been told that you are “throwing away money on rent.” Someone in your life made you feel guilty for not buying a home or building equity. And let me guess, you said something like, “Ugh, I just hated paying someone else’s rent!”

To the right?

There is only one problem: it is not true.

First, let me ask you a simple question: “Are you throwing money away” when you eat in a restaurant? Of course not. You pay for the value.

But somehow that logic falls completely apart when you apply it to real estate.

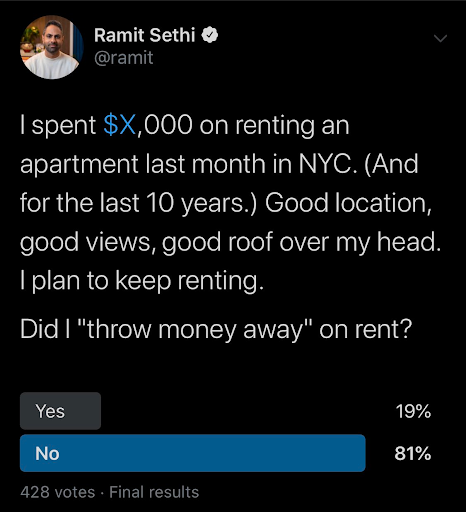

I decided to do a poll on Twitter to ask what people think.

Unsurprisingly, 95% of people said, “No, you didn’t throw away any money on a good meal.”

Then I asked the same question – but for rent.

LOL! Notice the decrease from 95% to 81% when I asked if I was throwing away money when renting. ”In other words, a lot more people believe that renting is throwing away money.

You and I know that when we spend $ 20 on a meal, we happily spend on good food, table service, and someone to clear our dishes.

Paying the rent is exactly the same: you pay for a roof over your head (the food). You also pay for a landlord to take care of all paperwork and maintenance issues (the service).

Why do so many of us blindly repeat this phrase, “throwing away money on rent”?

Why do people think rent is a waste of money?

Understanding why this myth persists is the first step in understanding the truth about buying and renting. Check out these reasons why many people believe rent is a waste – what do you notice?

1. Propaganda

The powerful real estate lobby, the government and our parents all tell us that “Real estate is the best investment of all”. There are even government tax incentives to buy! Repeat this for decades and a population will begin to believe blindly instead of running the numbers.

Here’s a little sneak peek at how the real estate propaganda machine works. In this article by the New York Times to buy a home subtly portrayed as the ultimate, foolproof way of getting rich in America. Fast. Hurry! Only prices go up! Add HGTV, economic malaise, and phrases like “you’re throwing away money on rent”.

“Minus expenses.” LOL. Given that “expenses” can be 10% of the selling price of a home, I say, “I really enjoyed this trip to the Grand Canyon! Everything except the part where my son fell off a cliff and died. In any case, it was fun! “

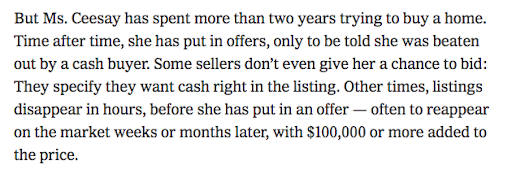

Hurry or you will be “priced out” forever. This is the message people get that leads them to make irrational financial decisions.

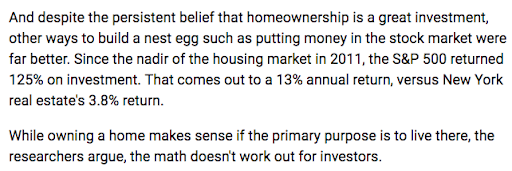

Hurry or you will be “priced out” forever. This is the message people get that leads them to make irrational financial decisions. In reality, real estate is not always the best investment. It is associated with significant phantom costs. And there are often better investments, such as a simple low-cost index fund. This is well understood by seasoned investors, but ordinary Americans have been fooled into thinking their primary residence is a great investment. Often it isn’t. (I could buy today, but I choose to rent because it’s the better option for me.)

2. Real estate financialization

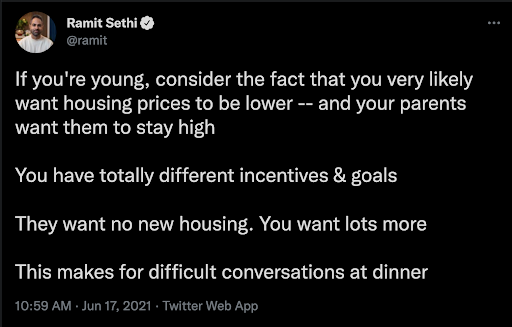

In America, we believe that our home should be an investment too. Why? This is not the case in many other countries. When you sit at the dining table with your parents, they want the price of their home to stay high – while younger people want the home prices to come down!

3. The idea that someone “takes you by surprise”

Americans HATE the idea of someone making money off of them. A Reddit comment said (rewritten) “If you buy it might cost more, but at least you won’t pay your landlord’s rent.” Do you understand how crazy that is? When you eat out, say, “I like the food here, but I just hate paying this restaurateur’s rent?” Of course not. We only repeat this sentence for real estate. Stop it.

4. Lack of understanding about phantom costs

People believe that if you buy a home for $ 200,000 and sell it for $ 450,000, you made $ 250,000. This is wrong. They don’t understand maintenance, taxes, and other phantom costs, and don’t compare ROI to other investments. Likewise, Did you know that real estate prices are falling too??

5. Following the same playbook as always

Buying a home has generally been a good thing for most boomers. There were also less affordable investment options such as index funds in the 1970s and 1980s. Stuck in the past, they re-teach millennials the same lessons that are faced with priceless housing, stagnant wages and better investment opportunities. That’s the problem when people (boomers) recommend something but don’t really understand why it works: they just repeat it over and over again even though the situation has changed.

What you should know about buying vs. renting

Renting is not necessarily better than buying and buying is not necessarily better than renting. It depends on many things:

My advice: do the numbers and educate yourself. But never say that you are “throwing away money on rent”.