No products in the cart.

Make Money Online

What is strategic asset allocation? How to stability your portfolio for the perfect returns

Strategic asset allocation is the practice of setting a goal for each of your asset classes (e.g. stocks, bonds, cash) and realigning them each year as you get income from your investments.

This is a great tactic if you:

- Focus on long-term financial goals

- Enjoy a hands-on approach to your portfolio – and don’t wring your hands over how the market is doing

- Reduce your risk as an investor

In this post, we’ll show you how to set up your asset allocation in a way that makes sense for your goals.

What are fixed assets?

When you invest, your money goes into various assets. These are government bonds Investment funds, Stocks, retirement plans and even real estate.

Not all of these assets carry the same risk. For example, stocks are considered riskier than government bonds, for example. Choosing your ideal asset mix will depend on a number of factors, including:

- Your age: Your allocation strategies shouldn’t be the same in your twenties as they were in your fifties. That’s because the risk needs to diminish towards the end of your investment journey so you can get more of your capital.

- Your willingness to take risks: The mix of asset classes depends on whether or not you are a conservative investor. Those willing to take more risk could add assets like cryptocurrencies to the mix or invest a higher percentage in stocks.

- Your goals: If you are saving up for a device that you plan to buy in a few weeks or months, there is no point in investing that money in a volatile, high risk stock. Sure, it might pay off and you will get back quickly, but that’s not the norm. Short-term investments should be made in a low-risk, even risk-free portfolio. Retirement is different, however, as investors often start in their twenties or thirties with the hopes of retiring in their late fifties to early sixties. This gives enough time to catch up with the many market declines that are synonymous with investing.

Why do we recommend strategic asset allocation?

Strategic allocation enables you to make your investment decisions consciously without being tied to the daily routine of day-to-day management. Sure, you may need to devote some time to this, but do it once a year if you can.

So how do you do that Automated investments. You can automate everything from money flowing into funds from your bank account to selecting funds and assets. You can even mandate to switch funds if there is a serious market slump.

How to set up a strategic asset allocation

Let’s start with an example first:

Imagine you are a 24 year old who just opened a brokerage account with $ 3,000. If you want to apply strategic asset allocation, you should set specific percentages for each asset class based on your goals.

Since you are young and have many years ahead of retirement, you may be more willing to take risks with your portfolio. With that in mind, choose to be aggressive and invest your money in 80% stocks ($ 2,400) and 20% bonds ($ 600).

A year later, you find that your stocks earned 20% of your initial investment, while your bonds earned only 2%. That leaves your net worth at 82% stocks ($ 2,880) and 18% bonds ($ 612).

Now your assets are “unbalanced” according to the goals you have set and it is time to rebalance them.

To stay in line with your strategic asset allocation strategy, you need to take 2%, or about $ 57.60, of your stocks into your bonds. This will keep your portfolio nicely balanced again with 80% stocks and 20% bonds.

Of course, your goals will change over time. As you get older, you may want to be more conservative with your investments and can change the asset allocation percentage to suit your needs.

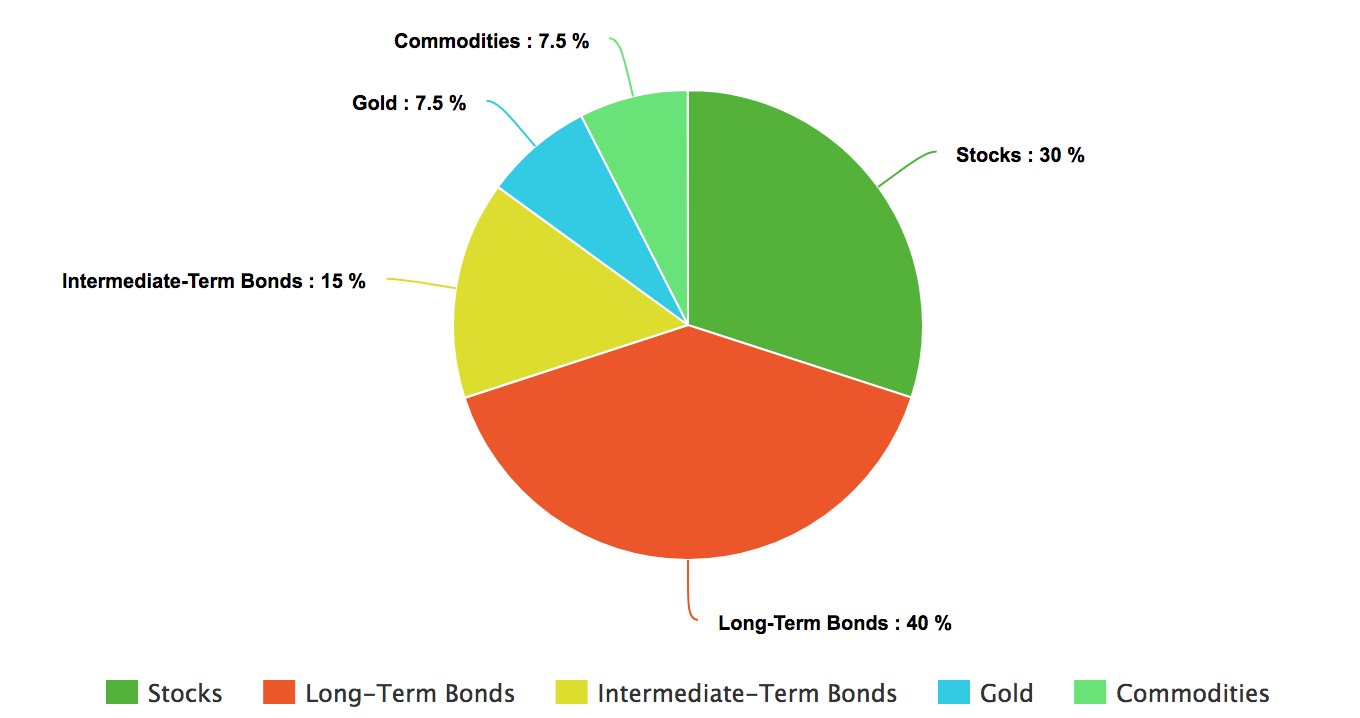

Consider the following scenarios, including your schedule and risk tolerance, to determine the asset allocation strategy that is best for you.

Determine your investment schedule

Your asset allocation should be adjusted based on the time you need to invest. For example, if you have a one year goal or a fifteen year goal, the investment strategies should be different. The shorter the term, the less risk you should have in your portfolio. Ideally, investments should run for at least ten years to get the most out of the markets.

Assess your risk tolerance

Risk tolerance is the risk you want to expose your capital to. An aggressive approach may not be for everyone, even if they have over 20 years to beat the markets.

It is important that you are comfortable with your risk tolerance as there is always the possibility of a loss while investing. The higher the risk, the higher the probability of loss. But there is also a chance of higher income. The point is, you need to be familiar with the potential of your risk class versus the potential for total loss.

Determine your goals

What is the point of investing and how will strategic asset allocation contribute to these goals? If your goal is to spend as little time as possible micro-managing your investments, then strategic allocation is your best investment friend. Add that investment automation and you have plenty of free time to do what you want instead of spending hours browsing newspapers, widgets, and indicators to maximize your ROI.

Sure, there is a time to step in, but knowing when and how often can strike a good balance.

- You want to spend less time figuring out financial jargon

- You prefer investment automation

- Risk tolerance is built into your allocations

- A review is scheduled every year to see if you are still on track and if your assignments are where they need to be

Buy funds in every asset class

This is an easy way to make sure you have a nice, diverse investment portfolio. And diversity counts. Remember when financial experts told everyone that real estate was the safest portfolio and that the likelihood of a market crash was just silly?

Turns out this actually happened, and we literally refer to it as a mortgage crash. Well, real estate is still worth a look when considering your investment strategy as the market has bounced back quite a bit. But here’s the thing. Don’t tie up all of your money in this one asset that seems to be doing well at this point in time. Those who could wait managed to get their money back and a lot more. Those who were retiring at the time of the crash, not so much.

Divide your wealth as much as possible to increase your chances of good returns and reduce your risk. Even if you invest in an asset, such as stocks, you split those funds even more. Consider index funds that include a fund basket so that you are as diverse as possible.

Rebalance your portfolio every 12-18 months

To stay balanced, you need to review your portfolio and rearrange funds to meet the allotment percentages you have set as your target.

Strategic asset allocation vs. tactical asset allocation

It is worth noting that these asset allocation strategies do not exist in isolation. Also, strategic asset allocation is just one way to manage your investments. Nor is there a rule that says you must stick to it for the next thirty or forty years when deciding which method to use.

It’s not uncommon for you to use multiple methods at the same time, even when you have a main method. For example, you can opt for a strategic allocation and sometimes use a tactical allocation as well.

Tactical allocation simply means that you are always in the thick of it, making even the smallest of decisions about your investments. It is the opposite of the strategic allocation model.

Fund managers often use a tactical approach to asset allocation, and it works because they know what they are doing. The goal here is to maximize profit and when that is done the portfolio is returned to its original state. It is meant to be a temporary measure only.

There are other assignment methods as well.

- Asset allocation with constant weighting: You assign certain percentages to certain asset classes, for example 80% stocks and 20% bonds. If the markets shift and you are suddenly 25% in bonds, adjust this immediately. Some investors let the balance tilt by up to 5% before adjusting their investment split.

- Dynamic asset allocation: You are in a constant game of buying and selling. When the markets are weak, sell, and when the markets are up, buy. This method shows the strengths of portfolio managers.

- Allocation of insured assets: This method allows you to set a base profit margin and, should your investments fall below that, start moving funds to secure assets that carry little or no risk.

- Integrated asset allocation: This method is entirely risk-based and may include aspects of the other methods. The selection of assets is made taking into account the risk appetite of the investor and all investment decisions are weighed against the risk, not against possible future returns.

Conclude

Investing can be as easy or as difficult as you want it to be, but if your portfolio strategy is solely about asset allocation, you are one step closer to a healthy asset mix. But if you really want to know all the pros and cons of investing, saving, and more, then you should check out our ultimate guide to personal finance.

Fill in your details below and start your journey to a rich life today.

100% privacy. No games, no BS, no spam. We’ll keep you posted when you sign up