No products in the cart.

Social Media Marketing

Collabstr Unveils the Trends and Stats within the 2024 Influencer and Creator Economy

Collabstr Unveils the Trends and Stats in the 2024 Influencer and Creator Economy

by Adam | January 31, 2024

In the ever-evolving landscape of the creator economy, Collabstr, a leading influencer marketplace, has once again pulled back the curtain, sharing key insights in its 2024 Influencer and Creator Economy Report. This annual report, sources first-party data from more than 35,000 brands and 80,000 influencers.

The report opens with a bold projection – the influencer marketing market is expected to skyrocket to $19.8 billion in 2024, signifying a remarkable 13.7% growth from $17.4 billion in 2023. This trajectory, surpassing the growth rate of social ad spending, underscores the unwavering resilience of creators amidst economic uncertainties.

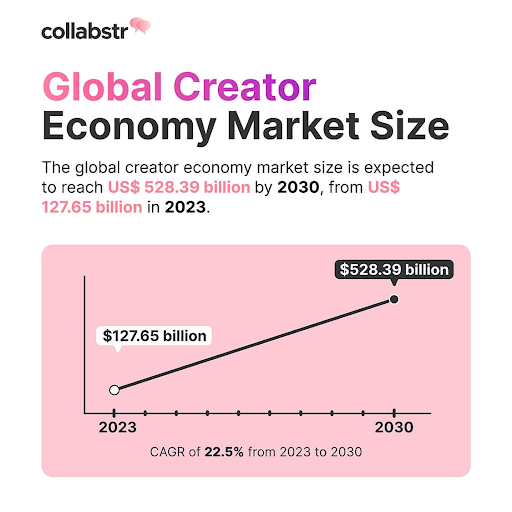

The global creator economy market size is expected to catapult from $127.65 billion in 2023 to an astounding $528.39 billion in 2030, driven by a compound annual growth rate (CAGR) of 22.5%. The growth is focused on in-app monetization features, which allows creators to create several income streams.

A resurgence in user-generated content (UGC) also took center stage in 2023, with a staggering 93% year-over-year increase in UGC creators. This modern-day “word-of-mouth” phenomenon is set to generate $71.3 billion by 2032, echoing a narrative of authenticity. Consumers, echoing the sentiment, are 2.4 times more likely to trust UGC over brand-generated content.

By 2024, Generative AI is anticipated to change the landscape of eCommerce UGC, bringing in a new era of customization. The report hints that AI-led personalization will significantly elevate user experiences, amplifying customer engagement by over 50%.

The report also shows the sustained dominance of TikTok and Instagram, claiming a combined 84% share in paid collaborations.

Across geographies, the USA, Canada, UK, Australia, and Germany stand as the leading epicenters of the influencer marketing landscape. Cities like Los Angeles and New York City retain their status as the top places where influencer transactions take place.

Lifestyle, fashion, and beauty remain influencers’ favorites, but a rising demand for education content suggests a subtle shift in consumer tastes, opening new avenues for creators. Additionally, the average spend per influencer saw a decline of approximately 16.8%.