No products in the cart.

Niche Marketing

CuriosityStream Inventory: Excessive Potential, Area of interest, And Execution (NASDAQ: CURI)

metamorworks/iStock via Getty Images

Investment Thesis

CuriosityStream (CURI) is trading at an attractive valuation. The nature of its streaming niche and the strategy execution are compelling for long-term investors, who stand to benefit either through repricing of the stock or an acquisition.

A Different Take on Streaming

Most investors associate streaming with gruesome business wars to acquire customers and equally dreadful cash consumption to develop a competitive content library. Also, some markets, especially the United States, are beginning to show saturation and investors are taking stock of this as we have witnessed with Netflix (NFLX) shedding $50B overnight only a few weeks ago.

Nonetheless, there are opportunities in this industry worth looking at. CuriosityStream is a provider of factual entertainment delivered via a direct subscription video on-demand ((SVoD)) platform with approximately 20M subscribers. The library counts about 5000 titles spanning science, history, nature, society, lifestyle, and technology. Customers can access CuriosityStream by subscribing directly or through distribution partners via the distributor’s platform.

CuriosityStream benefits from focusing on the factual entertainment niche.

Large Total Addressable Market

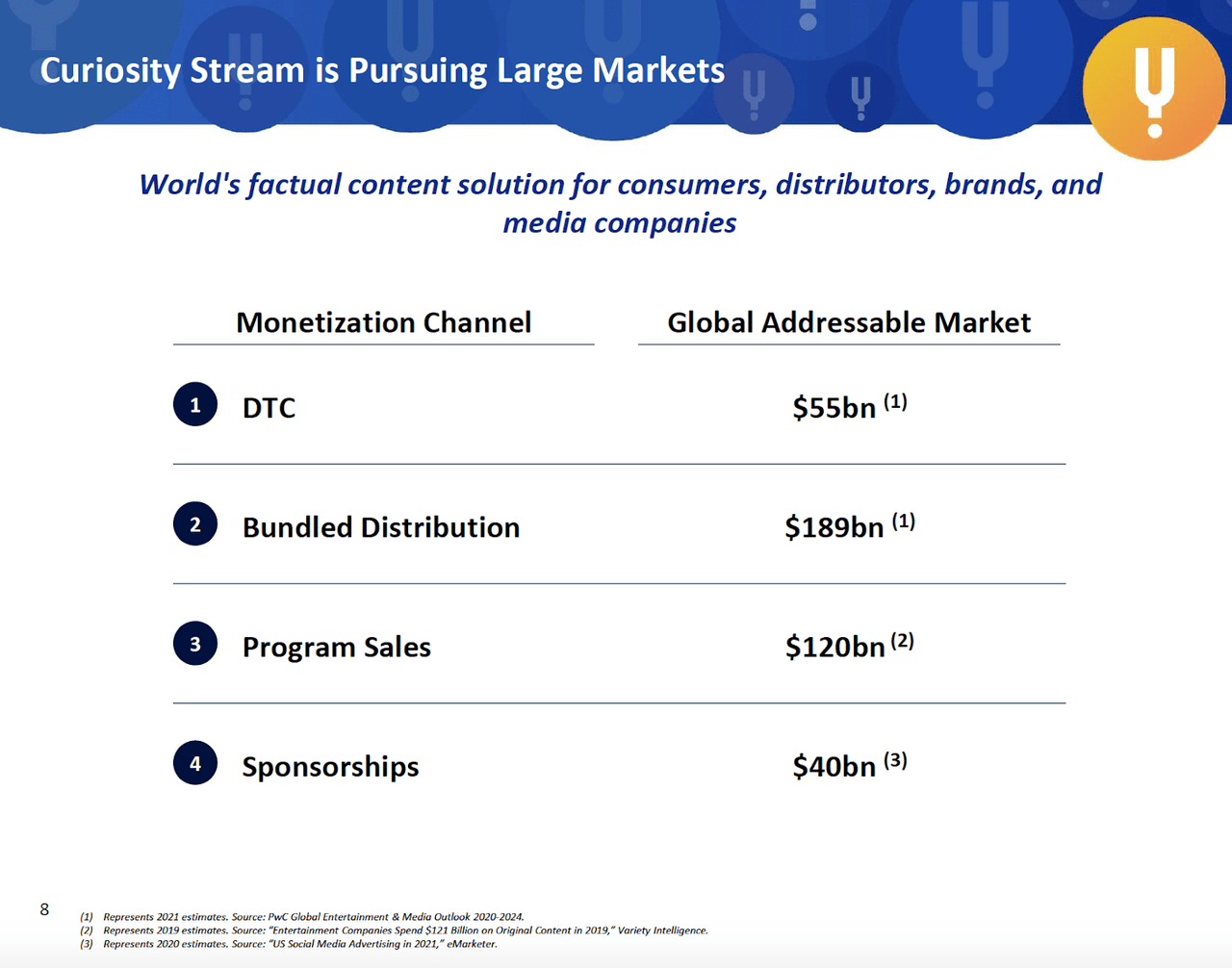

The Total Addressable Market (TAM) is approximately $400B as presented by the company. Direct to Consumer (DTC) and Bundled Distribution represent the consumer streaming market for factual entertainment, while Program Sales and Sponsorship are in the B2B arena. Having the capability of producing and selling proprietary content adds a significant portion to the streaming TAM.

CuriosityStream Q3 FY21 Presentation

Efficient Content Investment

Documentaries are orders of magnitude cheaper to produce than fiction, we are talking tens of thousands of dollars per hour of content compared to hundreds of thousands or even millions for HBO’s Game of Thrones. Of course, even the best documentary will not become a money machine such as Game of Thrones, but the point is that you can grow a proprietary library quickly without risking nearly the same amount of capital while avoiding hit or miss investments in case your series flops. Documentaries are for the most part language agnostic and can be offered pretty much anywhere with marginal investment.

CuriosityStream Differentiators

Management Experience & Industry Credibility

Behind CuriosityStream there is John Hendricks, the founder of the Discovery Channel, which remains its largest shareholder with 40% of ownership. The company also banks on years of industry experience and relationships through its executive team.

Content Strategy

CURI’s content strategy is a blend of own production (about a third) and license acquisition for the rest. Own productions are also sold to distribution partners that do not compete geographically or in the same distribution channel, which de-risks the investment, at times even at pre-production stage. Beyond that, CURI is active in minority investments and acquisitions. It acquired a minority stake in Nebula, a creator-owned streaming platform, and Spiegel TV, two documentary channels for German pay-TV audiences. Other acquisitions are One Day University, which provides access to lectures from professors at colleges and universities in the United States, Learn25, which delivers online courses by professors and subject experts. While financial benefits are negligible at the moment, the company benefits from a high complementarity to the core offering and paves the way to higher average revenue per user (ARPU) through bundling and subscription tiering.

Revenue Channels Growth and Differentiation

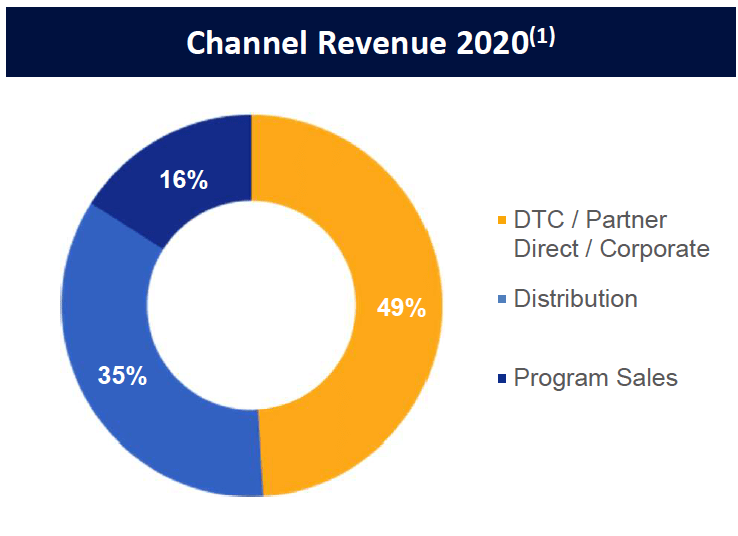

CURI generates revenue from Subscriptions and License Fees.

Subscriptions are about half as of December ’20 and cover both the own platform and the revenue generated based on agreements with certain streaming media players, Smart TV brands and, gaming consoles (e.g. AppleTV). Growth of this revenue stream will come from additional bundled distribution agreements and the addition of subscribers, the latter aided by translating content into other languages. Future price increases will help lift subscription revenue. Investors stand to benefit from the inherent operating leverage, which is amplified by the company investing in producing its content.

License fees cover Distribution and Program Sales. In Distribution, with clients such as Altice, Comcast, and Amazon, revenue is earned by licensing content on a fee x subscribers volume basis. Program Sales grant a licensee limited distribution rights to the Company’s programs, generally in exchange for a fixed fee.

CuriosityStream Q3 FY21 Presentation

These revenue streams are not fully independent as they ultimately depend on the same quality of the content and/or streaming infrastructure but certainly are a positive. CURI has an advantage here because revenue coming from B2B sources affords greater flexibility in customer acquisition spending for the consumer streaming business.

Customer Relationship

CURI has industry-leading figures when it comes to churn. The average churn for streaming video on demand (SVOD) services is estimated by Deloitte to be at 35% in the US, while CURI stands at a spectacular 3%. Additionally, 85% of subscribers are on an annual plan, proving CURI has a solid grasp of its customer base, which is willing to commit for a relatively long term. Its global distribution (65% of subscribers are outside of the US) contributes to this metric by differentiating away from overcrowded markets. Unfortunately, this key metric is unlikely to improve as competition will eventually reach the niche but is a testament to good execution. A positive note is that such low churn figures point toward an inelastic demand which makes it easier to raise prices.

Acquisition Option

CURI has the potential to become an acquisition target by other media/streaming players. The industry is showing signs of consolidation and as customer acquisition becomes more costly, capital could be deployed for inorganic growth initiatives. CURI is an attractive valuation as presented later in this article.

Financials

Revenue Growth & Cash Flows

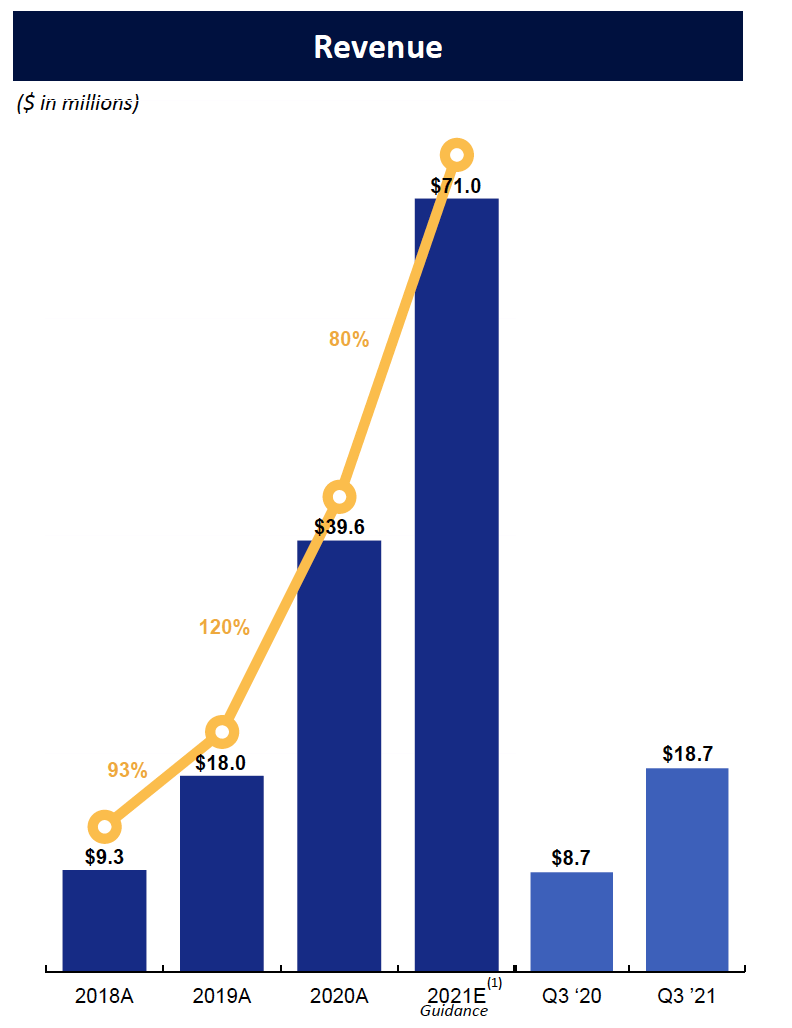

The company guided for $71M of revenue for fiscal ’21, an 80% growth YoY, it is not operationally profitable as it invests to ramp up hiring, aside from the expected content and marketing spend.

CuriosityStream Q3 FY21 Presentation

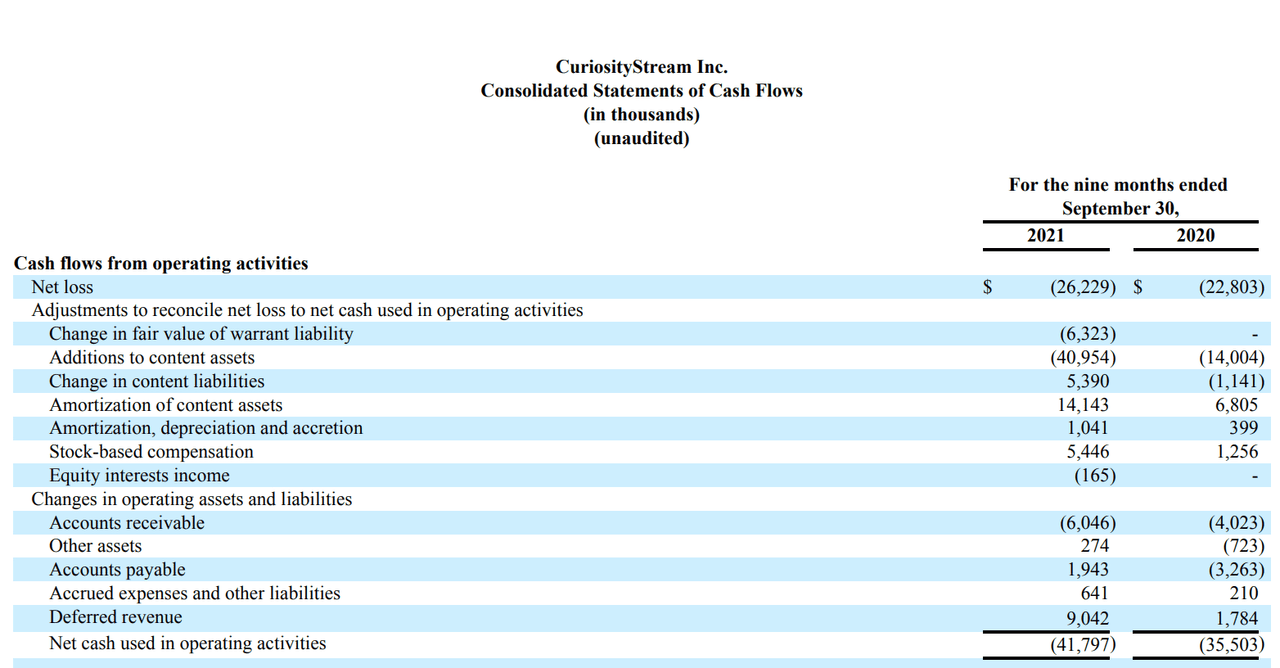

Comparing operating cash flows up to 3Q in ’20 and ’21, cash used grew from $35M to $42M which is a modest increase considering the growth trajectory. A major line of cash consumption is the investment in content but was partially offset by a large increase in deferred revenue. The added benefit derived from customers preferring the annual plan (85%) over monthly payments is that the streaming sales cash flow is frontloaded, no small advantage when you are in high growth mode. In the most recent quarter, CURI showed $80M of net cash, which should give it enough runway to achieve break-even without tapping the capital markets, although this remains a risk.

CuriosityStream Q3 FY’21 10Q

Valuation

Currently, the market cap floats in the 200M to 240M range. Considering that CURI has 20M subscribers, some quick math tells you $10 to $12 of market cap per subscriber, this seems quite low especially considering 85% of them are on the annual plan selling at $19,99. It is hard to find the right comparable for CURI but there certainly is valuation room upwards, for example for the Price/subscriber metric, Netflix, even after the recent sell-off, will set you back a cool $800/subscriber.

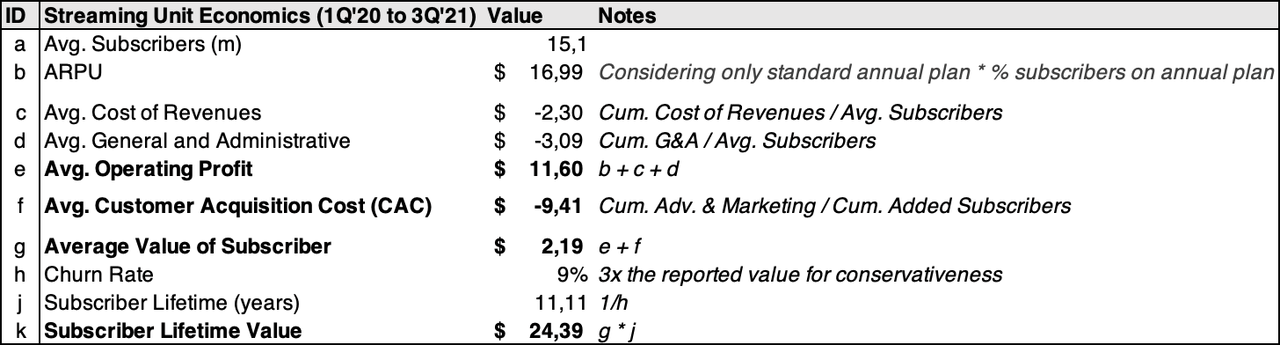

So, CURI is cheap on a relative basis, but what are you getting at this valuation? Here is a quick some-of-parts valuation. Allowing some simplification, the parts are Subscribers’ value, content assets, and cash. How much is a subscriber worth? I computed a simple unit economics using data covering the last 7 quarters.

Author

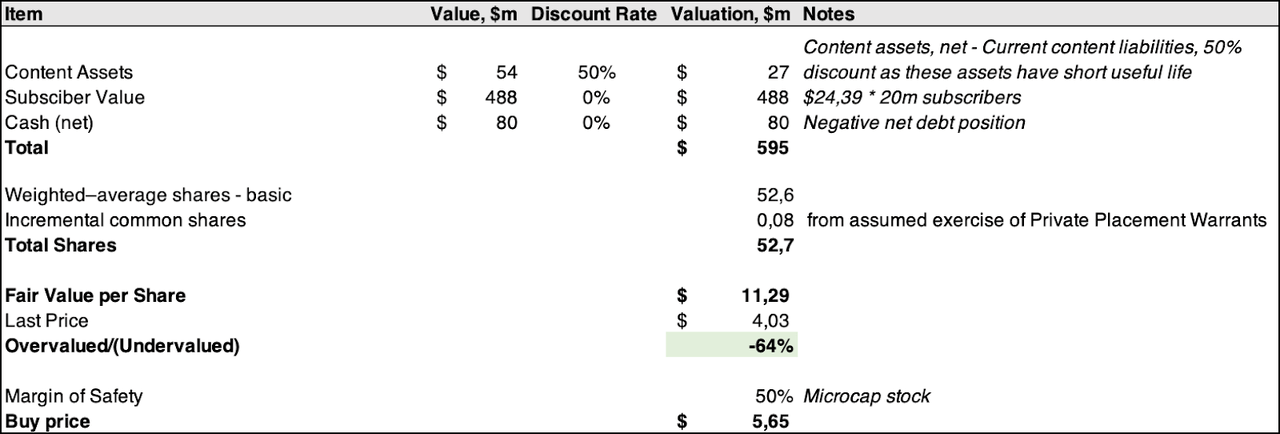

A subscriber lifetime value of approximately $25 seems quite conservative. What about the rest?

Author

This valuation purposefully errs on the side of caution, completely excluding the fact that the company is growing almost triple digits, among other aspects. For reference, the Tangible book value per share is $1,99/ share.

Risks

The company is in full investment mode so expect every dollar generated to be reinvested. There is a risk connected with the execution in two areas: content strategy and customer acquisition. Inefficient use of funds would land the company in the position of having to raise additional capital which could dilute shareholders. I do not see this as a major threat at the moment since the company generates cash and content CAPEX is largely to management discretion. A systemic slowdown of the streaming business is broadly expected and already happening as the pandemic brought forward demand significantly, this may impact growth expectations and the stock price. CURI is exposed to these market dynamics directly but also indirectly through bundling agreements.

Summary

I rate CURI a Strong Buy based on the attractiveness of the streaming niche, strategy execution and, valuation. I have built a small position in my GARP portfolio at an average cost of $4.4 and the goal is to increase it. Even if my view on the company is positive, I remain on the lookout for the full-year results due at the end of March, 4Q is very important from a customer acquisition perspective, and the overall macro environment for tech and streaming stocks. The stock is highly volatile and still has some short interest so exercise extra caution for this microcap.