No products in the cart.

Make Money Online

A Detailed Information for 2021

Investing is the one most important factor you are able to do to make sure your monetary future — and the earlier you begin, the better it’s to get wealthy. There may be greater than 100 years of proof within the inventory market that means this.

Shares and bonds are a terrific place to start out, so we’re going to dig into that on this submit. However first, let’s discuss concerning the typical perceptions of investing.

Individuals nonetheless don’t perceive what investing is precisely. People appear to assume there’s some magical method to make a fortune with shares and bonds. From what I’ve seen, the 2 issues folks get most improper about investing are pondering:

- It’s a 24-hour Wolf-of-Wall-Avenue—model get together the place merchants make hundreds of thousands of {dollars} day by day whereas screaming “SELL! SELL!!” right into a cellphone.

- Investments are extremely dangerous as a result of all of the pundits scream “monetary disaster!” at even the slightest dips within the markets.

And, frankly, you’ve each cause to consider this.

Because of Hollywood and the (annoying) speaking heads on cable information, we’ve come to consider funding as a maniacal creature that’s not suited to the common particular person… and many people simply don’t perceive precisely how investing works.

That’s why we need to dispel a few of these myths and notions surrounding investing by specializing in a number of the commonest matters you’ll hear on the subject of investments:

How do shares and bonds work? How are you going to steadiness them in your portfolio? What’s the distinction between shares and bonds?

This text isn’t going to be about which shares are sizzling proper now or what kind of funding technique goes to make you right into a zillionaire at present. When you’re on the lookout for one thing like that, I recommend you return to watching the pundits on cable information.

SPOILER ALERT: Cramer has accomplished a lot worse than the S&P 500 since 2008.

As a substitute, stick round for a no-BS lesson all about shares and bonds, what they’re and what half they’ll play in your funding future.

How do shares work?

Whenever you personal an organization’s inventory, you personal a part of that firm. Shares are additionally known as fairness for that cause — you personal a tiny piece of the corporate.

Inventory fundamentals

If the corporate does nicely, your inventory will do nicely. So, ideally, you need to spend money on strong-performing corporations.

You should purchase and promote everytime you need via your dealer or self-serve websites like E*Commerce or TD Ameritrade.

Inevitably, at any time when I’m educating somebody concerning the fundamentals of shares, somebody will pipe up with a myriad of questions like these:

- “What shares ought to I purchase?”

- “Is X firm funding?”

- “Is $XX an excessive amount of for this inventory?”

Very first thing’s first: SLOW DOWN.

Earlier than you make an funding in any kind of inventory, you’re going to need to cease and make sure you perceive easy methods to go about deciding what shares to purchase. Understanding shares is step one earlier than you begin piling your cash on no matter appears good on the day.

Selecting the best inventory

The best method to slim down the universe of inventory choices is to consider corporations you want and use.

Take a while proper now to jot down down 15 corporations you employ and return to time after time.

Consider every thing. For instance:

- Meals: Complete Meals, Conagra, Shake Shack

- Clothes: Beneath Armour, Restricted Manufacturers, Etsy

- Companies: IBM, UPS

- Expertise: Apple, Microsoft, Snap

- Leisure: Disney, Dwell Nation, Netflix

- Transportation: Tesla, Ford, CSX Company

As a substitute of 5,000 inventory choices to select from, you now have 15 corporations you may presumably spend money on.

Keep in mind: firm isn’t essentially inventory!

For any inventory, you’re going to want a deeper evaluation than “I feel khakis from Hole are superior, so I’ll purchase inventory from them!”

As a substitute, you’re going to need to have a look at 5 totally different areas:

- Developments: Are gross sales growing from this time final 12 months? 2 years in the past? 5 years in the past?

- Merchandise: Is the long run vibrant when it comes to upcoming product growth? What information have you ever heard about their future merchandise?

- Revenues/earnings/progress/earnings per share: The true monetary nuts and bolts of a inventory. These are intimidating at first. Fortunately, many websites will information you thru it.

- Insider buying and selling: Are senior executives on the firm shopping for extra shares (indicating they’ve confidence within the firm) or promoting?

- Administration: Is administration good? What’s the turnover? What’s their philosophy and skill to execute?

You may get all of this data on-line without spending a dime — and also you’d be sensible to do as a lot analysis as you presumably can. When you see a cause to doubt an organization based mostly on any of the areas above, keep away from that inventory.

Bonus: Need to know easy methods to make as a lot cash as you need and reside life in your phrases? Obtain my FREE Final Information to Making Cash

Inventory analysis assets

Listed here are some nice web sites that will help you begin out:

At first, the entire charts, earnings, and steadiness sheets might be extremely complicated — however the extra you look into them the extra you’ll begin to get sense of what’s happening. It simply takes follow.

Benefits of investing in shares

- You possibly can actually make some cash in case your inventory is sweet. In case your inventory is superb, you possibly can actually beat the market. You possibly can choose the inventory in an trade you perceive.

- Your cash is liquid, which suggests you possibly can entry it at any time by promoting your inventory.

Disadvantages of investing in shares

- Sadly, if an organization does poorly, so does your inventory. As a result of a inventory isn’t diversified, that may imply catastrophe for you (though you possibly can simply scale back your danger by choosing larger, stable corporations).

- There’s no assure in your funding, not like with bonds. You might make no cash and even lose cash available in the market.

What are bonds?

Bonds are like IOUs that you just get from banks. You’re lending them cash in change for a hard and fast quantity of curiosity.

Bond fundamentals

When you purchase a 1-year bond, the financial institution says, “Hey, when you lend me $100, we’ll offer you $102 again in a 12 months.”

The approximate present fee of return for a 2-year bond is about 2%. (Verify right here for the up-to-the-second quantity.) Total, bonds are:

- Extraordinarily secure

- Assured to have a return

- Smaller of their returns

With these qualities, what sort of particular person would spend money on bonds?

Effectively, anybody who needs to know precisely how a lot they’re getting subsequent month ought to spend money on bonds. It doesn’t matter when you’re in your twenties or when you’re in your seventies. If you need a secure funding — regardless of the decrease returns — then bonds are for you.

In spite of everything, some folks simply don’t need the sort of volatility the inventory market gives. And that’s fantastic.

Benefits of bonds

- You understand precisely how a lot you’ll get while you spend money on a bond.

- You possibly can select the quantity you need a bond for (1 12 months, 2 years, 5 years, and so on).

- Longer time intervals can yield you greater return charges.

- Bonds are extraordinarily secure, particularly authorities bonds. The one method you’d lose cash on a authorities bond is that if the federal government defaulted on its loans — and it doesn’t try this. It simply prints extra money.

Disadvantages of bonds

- As a result of they’re so secure, the reward on a wonderful bond is dramatically lower than a wonderful inventory.

- Investing in a bond additionally renders your cash illiquid, that means it’s locked away and inaccessible for a time frame until you’re prepared to incur an enormous penalty to take it out early.

- Not like shares, bonds are arduous to purchase and promote as a person.

What’s the distinction between shares and bonds?

Now we’ve coated the fundamentals of what shares and bonds are, let’s take a better have a look at the principle variations between them.

The primary methods shares and bonds differ are in 3 ways:

- Sort of return

- Return assure

- Advantages

Sort of return

The primary method that shares and bonds differ is in how the proprietor will get a return on their funding. With shares, since you personal a chunk of an organization, you possibly can obtain dividends. These are firm earnings handed out to shareholders.

With bonds, you obtain a return via curiosity gained, as a result of what you’ve purchased is mainly a debt.

One other method to generate income with both shares or bonds is to promote them for a better value than you obtain them, however this depends upon quite a lot of various factors.

Return assure

The one factor that just about everybody is aware of concerning the inventory market is that it’s dangerous. There are zero ensures that you’ll make your a reimbursement, by no means thoughts extra on prime of that. That’s the principle factor that places folks off from investing within the inventory market.

Those that are particularly risk-averse may need a happier time with bonds although. As bonds are debt investments, the corporate or authorities you purchase the bond from has to pay you again. There’s no method round it, so that is excellent news for you.

You get a assured return in your funding within the type of curiosity. The draw back is that the returns are often a lot decrease than shares.

Advantages

The third method shares and bonds differ is with advantages. The benefit of shares is that you just’re a shareholder, which suggests you may have voting rights inside that firm.

This does rely upon the shareholder setup, nevertheless. So, don’t count on to waltz via the doorways at Apple HQ and make large adjustments since you purchased one share.

With bonds, however, the principle profit you will get is preferential remedy when that bond matures.

What’s fairness vs. debt?

The 2 sorts of funding you must learn about are the fairness and debt markets. These refer to 2 other ways investments are purchased and offered. Within the debt market aka the bond market, investments in loans are purchased and offered. Within the fairness market or inventory market, it’s fairness in an organization that’s purchased and offered. Typically, the fairness market is deemed a better danger than the debt market.

How does the bond market work?

The bond market or debt market works by an organization taking a mortgage out. As a substitute of heading over to the financial institution, they’ll get that funding from buyers who purchase bonds.

The corporate then pays an “curiosity coupon” which is the annual rate of interest paid on a bond.

Bonds fall into both short-term, medium-term, and long-term. Brief-term bonds “mature” or are paid off primarily inside one to 3 years. Medium-term bonds final round ten years and long-term bonds mature over for much longer intervals of time.

Do you earn capital positive aspects on bonds?

Capital positive aspects are what you earn after you promote an asset for greater than you obtain it for. For instance, if you buy a home and it shoots up in worth by the point you promote it, you simply made a capital achieve. Within the inventory market, when you promote a inventory for a better value than you obtain it, congratulations, you simply made a capital achieve.

However what about bonds?

Bonds are just a little trickier as a result of they’re usually a bit more durable to promote than shares. With bonds, your supply of earnings is said to curiosity fairly than fairness earnings.

Bonds are sometimes not held till they hit maturity and are offered earlier than then. When you do that, you may earn a capital achieve (or loss) relying on what has occurred to the corporate that offered you the bond. When you handle to promote your bond for greater than you obtain it, it is a capital achieve.

How does the inventory market work?

The inventory market or fairness market is a market the place the share of possession in an organization is purchased and offered.

There are two most important methods to generate income from shares—dividends and promoting.

House owners of shares can revenue from dividends, a share of firm earnings that shareholders obtain. It is perhaps a bit bizarre to consider your self as a shareholder… however that’s precisely what you’re when you personal a inventory.

Relying on a myriad of things, whoever owns inventory can even revenue after they promote it. However this solely works if the market value has elevated since you obtain it.

The inventory market is a little more unstable than bonds. Shares can shoot up in worth or plummet for an entire vary of causes. Shares may be affected by social adjustments, politics, financial occasions, and even the CEO tweeting (eye roll emoji).

This makes them a riskier funding, however that’s why you must educate your self on them. And when you’re nonetheless right here congratulations!

How must you steadiness shares and bonds in your portfolio?

So now we’ve coated the fundamentals of shares and bonds, the query is: What do you spend money on? You are able to do both shares or bonds however a mixture of the 2 is a well-liked alternative. It spreads your danger and diversifies your portfolio—one thing it’s best to all the time intention for.

However which must you make investments extra in? The safer, assured however low returns of bonds or the upper danger, greater reward shares?

Effectively, there’s no clear-cut reply right here. All of it depends upon…

- Your angle to danger

- How near retirement you’re

Funding portfolios all fall someplace on a scale of tremendous aggressive to conservative.

An excellent aggressive funding technique can be to place 100% of your cash into shares. A conservative portfolio would have not more than 50% in shares.

For average progress, you’ll need to have a look at extra of a 60/40 cut up of shares and bonds.

How does that relate to retirement?

In case your portfolio is a key a part of your retirement technique, then the quantity of danger it’s best to take depends upon how shut you’re to retirement. In different phrases, when you’re nearing retirement, you don’t need to dump all of your cash on high-risk shares. You’ll need to rebalance your portfolio to be a bit safer and predictable. On this case, you’d most likely go for the extra conservative cut up.

Those that are youthful have a bit extra flexibility as a result of typically, the extra time available in the market, the extra time your portfolio has to get well if it takes a dip.

How do you begin investing in shares or bonds?

So now you’re all crammed in on what shares and bonds are, how do you begin investing in them? Because the style for investing grows, so do the choices obtainable to us. Now it’s simpler and extra accessible than ever. Listed here are a couple of in style choices to get began:

Use a web based brokerage

Presumably the most well-liked methodology of investing is to make use of a web based brokerage. This works a lot in the identical method as a conventional in-person dealer does however the charges are decrease and you are able to do all of it via your smartphone.

On-line brokerages allow you to purchase all sorts of investments together with particular person shares, funds, and bonds via a web site or app.

Mutual funds

One other in style method to make investments is to make use of a mutual fund as a substitute of investing in particular person shares. Mutual funds are made up of a number of totally different corporations so the danger of funding is unfold fairly than focused and dangerous.

Not like many on-line brokerages, mutual funds usually have a devoted fund supervisor who picks the very best investments for you. This implies they arrive with a lot greater charges in consequence.

Index funds

Index funds are made up of a bunch of corporations so the danger is unfold. The primary distinction between index and mutual funds is that index funds are passively managed.

This implies they’re the cheaper possibility they usually’re additionally the much less unstable possibility. Reasonably than attempting to beat the market, index funds watch it and make smart investments.

Robo-advisors

It would sound a bit sci-fi, but it surely’s fairly easy. A robo-advisor is a digital platform that invests your cash via automation and algorithms. There’s little or no human contact concerned (nice for introverts) so it’s a really hands-off sort of investing.

Funding managers

Lastly, if in case you have the money to splash and need to make some severe investments, hiring a devoted funding supervisor is an alternative choice. That is the costliest possibility as you’ll be getting recommendation and tailor-made service. So it’s not excellent for many who need to lower your expenses on charges.

IWT’s funding philosophy

In the case of what you need to spend money on, shares and bonds are each stable investments — so long as you do your analysis.

What I feel EVERYBODY ought to be doing on the subject of their investments is straightforward: low-cost, diversified index funds.

Let’s have a look at a real-world instance.

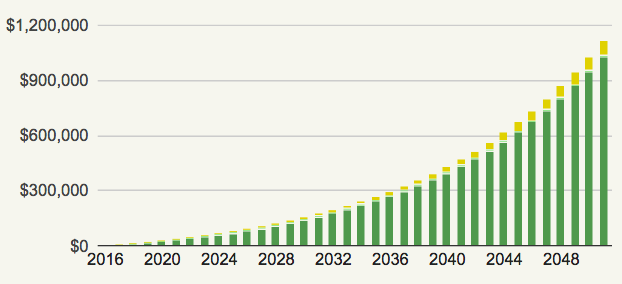

Say you’re 25 years previous and also you determine to speculate $500/month in a low-cost, diversified index fund. When you try this till you’re 60, how a lot cash do you assume you’d have?

Have a look:

[insert graph from original article]

$1,116,612.89.

That’s proper. You’d be a millionaire after solely investing a couple of thousand {dollars} per 12 months.

Good investments are about consistency greater than chasing sizzling shares or anything:

The 2 important methods to speculate your cash are easy:

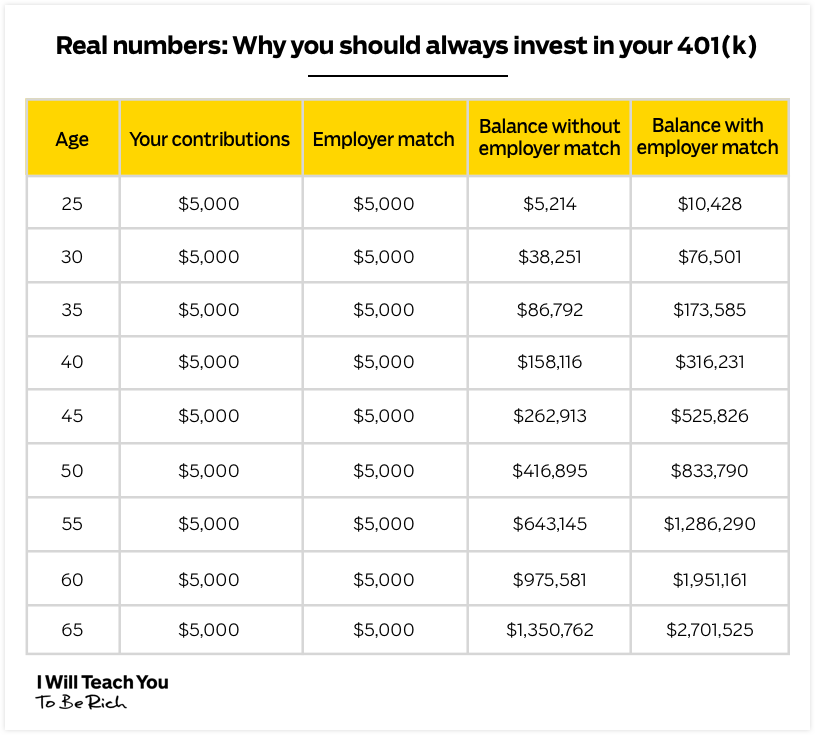

- 401k: Reap the benefits of your employer’s 401k plan by placing a minimum of sufficient cash to gather the employer match into it. This mainly implies that for each greenback you contribute, your organization will match that (pre-tax!). This ensures you’re taking full benefit of what’s primarily free cash out of your employer. That match is POWERFUL and might double your cash over the course of your working life:

- Roth IRA: Like your 401k, you’re going to need to max it out as a lot as attainable. The quantity you’re allowed to contribute goes up sometimes. At the moment, you possibly can contribute as much as $6,000 every year.

Notice: If $500/month feels like lots, learn all of the methods you possibly can liberate that cash with just some cellphone calls.

In case you are simply beginning out, it’s so superior that you just’re right here.

For monetary safety, it’s extra essential than anything to start out early. And don’t fear when you assume you’re just a little late to the sport. In spite of everything, the very best time to plant a tree was 20 years in the past…the second-best time is NOW.

Man, I’m beginning to sound like a fortune cookie.

Get began in your private finance journey

When you’re wanting into funding, congratulations! You’re making an essential step in securing your monetary future. Funding isn’t the one factor to consider although. Nor are shares and bonds.

For a full-picture strategy to private finance, be sure you take a look at The Final Information to Private Finance.

In it, you’ll be taught not solely easy methods to perceive shares and bonds, but in addition easy methods to:

- Grasp your 401k: Reap the benefits of free cash provided to you by your organization…and get wealthy whereas doing it.

- Handle Roth IRAs: Begin saving for retirement in a worthwhile long-term funding account.

- Automate your bills: Reap the benefits of the great magic of automation and make investing pain-free.

Have you learnt your incomes potential?

Take my incomes potential quiz and get a customized report based mostly in your distinctive strengths, and uncover easy methods to begin making more money — in as little as an hour.