No products in the cart.

Make Money Online

Ballot: Toxic Financial Advice – I will Train You How To Get Wealthy

The central theses

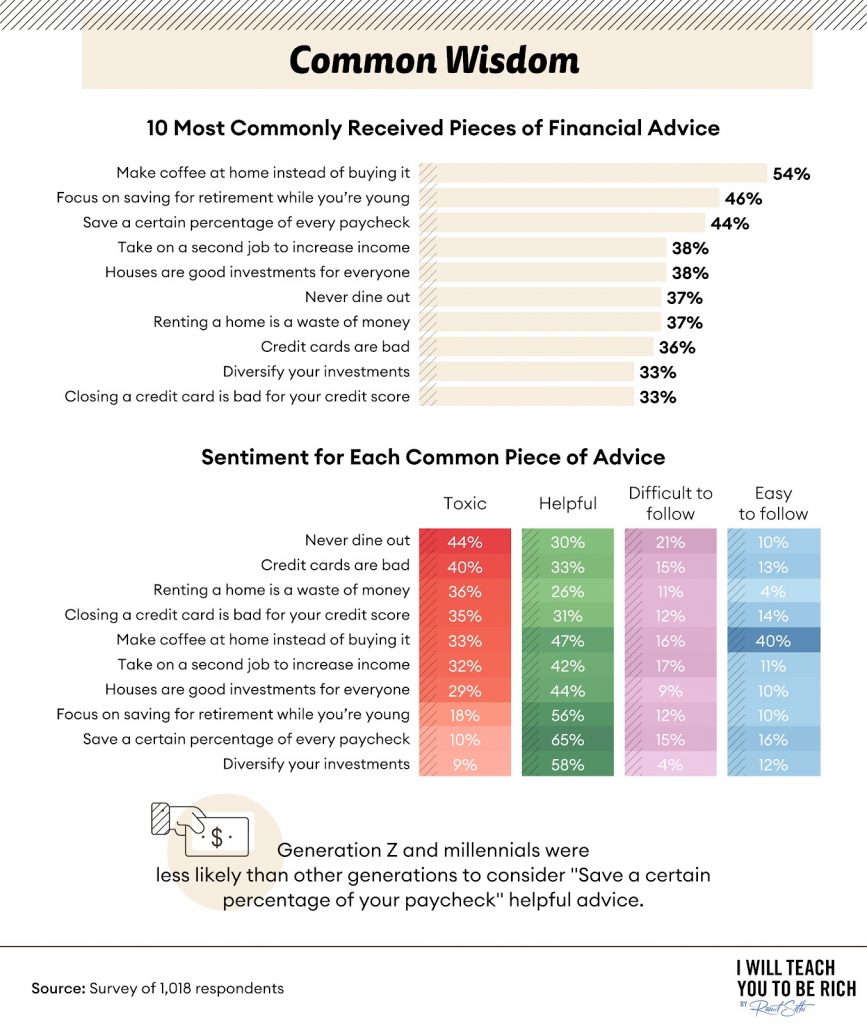

- “Never eat out” is the most toxic financial advice, followed by “Credit cards are bad” and “Renting a house is a waste of money” in second and third place.

- “Saving a percentage of every paycheck” is the most helpful financial advice, followed by “diversify your investments” and “save for retirement while you are young” in second and third place.

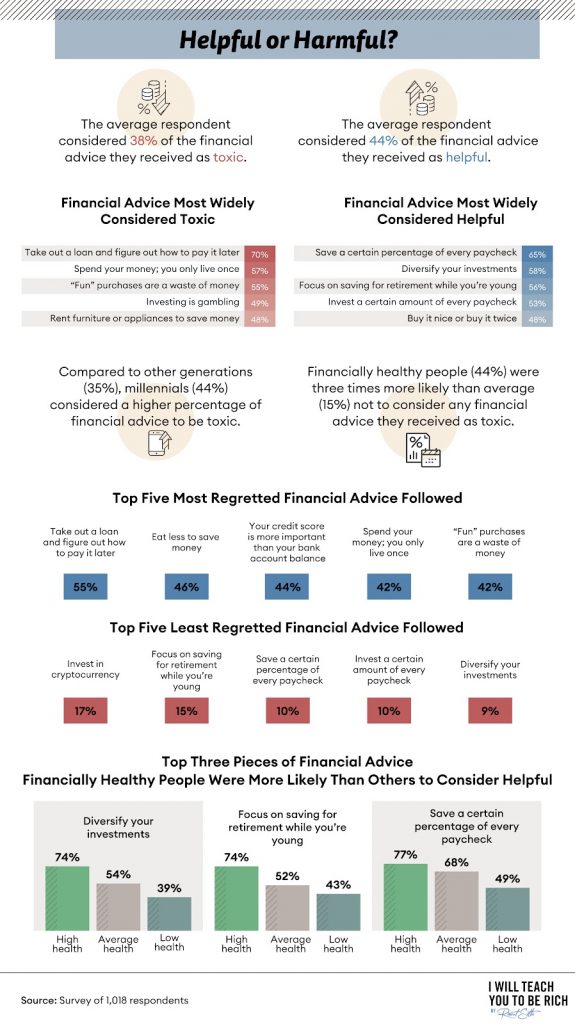

- Financially healthy people were three times less likely than the average to think that some of the financial advice they received was toxic.

Financial advice is often given voluntarily by well-meaning friends and family. While well-intentioned, much of this advice may not always be helpful.

With so many financial strategies floating around, some may not fit your specific goals. In other cases, money management tips can be downright detrimental to your financial health. To get an insight into the topic of money management consulting and whether it is helpful, we asked over 1,000 respondents. Read along for the next few minutes as we uncover people’s thoughts as to what advice is worth following.

Popular finance tips

If you ask 10 different people for advice on the same financial problem, you will likely find 10 different strategies. It is undeniable that there is an abundance of financial advice out there, but distinguishing what is helpful and what is not can be the real challenge. Chances are that, similar to our respondents, you have received a lot of money management tips. Here we look at some of the most ubiquitous.

A significant part of the financial advice cited related to houses and apartments. For example, 54% of respondents were given advice on making coffee at home and 38% heard that buying a home is always the right move. Often times, depending on your lifestyle or the area you live in, renting can be the way to go right decision. Real estate is booming in many markets today, so the supply of apartments is limited in view of the high demand. While home ownership may be the right decision for some, renting it may be the right decision for many others.

Another tidbit of financial advice focused on how early to start saving for retirement. Saving money is always a good idea and the sooner the better, say 46% of our respondents. While many have heard that eating at home is a huge cost savings and credit cards are never a good idea, one single strategy is rarely best for everyone.

If a relative (or several) advised you “never put all your eggs in one basket,” it is likely that they meant your money, too. That’s why 33% heard that diversification is always best. From a generational perspective, Gen Zers and Millennials were less moved by the oft-heard talk of “save a part of every paycheck”.

Probably much of the financial advice comes with good intentions. However, good intentions do not necessarily mean that it will be well received. Yes, eating exclusively at home can save you money, but 44% thought such advice was “toxic,” as did the 36% who were told that renting is money wasted. Making coffee at home is a cheaper alternative to buying drinks starting at $ 5.00 from specialty stores, and 40% of respondents said it was easy to do. A third still found such advice to be “toxic” – we would agree with that. Focusing on $ 5.00 money issues is distracting. Concentrate on greater financial gains will lead to more success in the long run.

Money counseling differs between gender and age

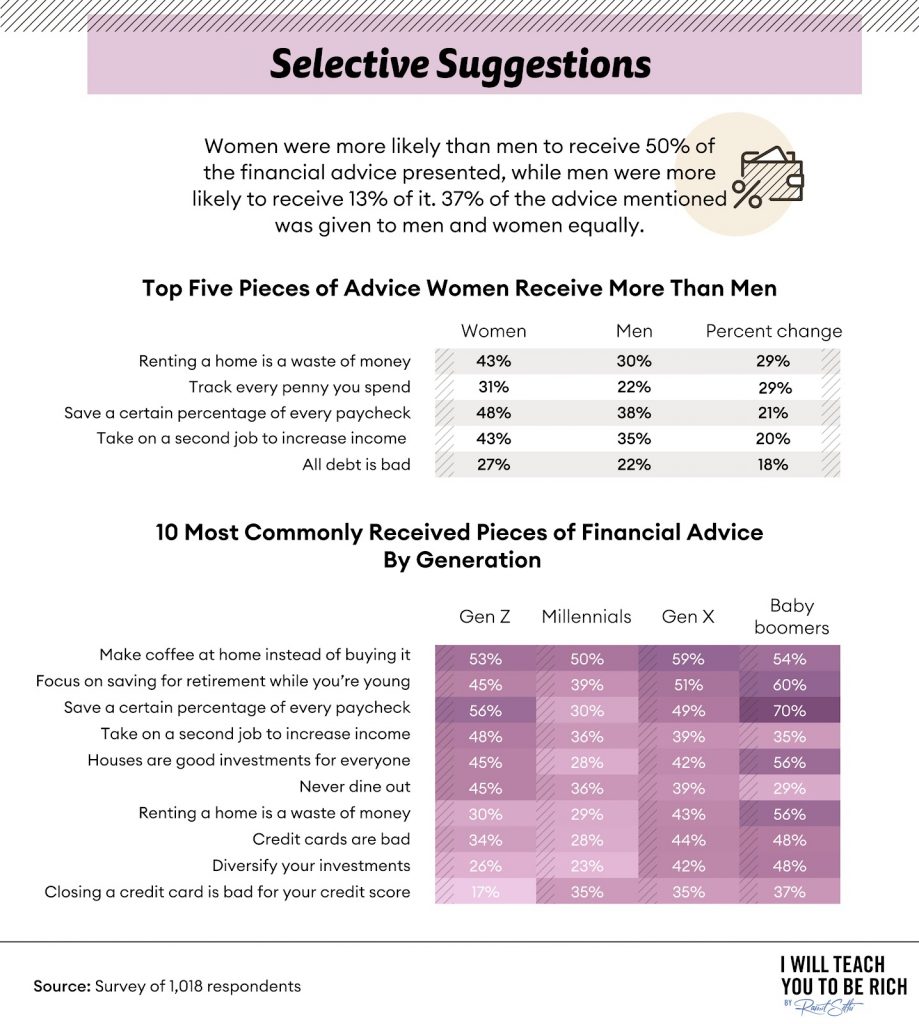

Not all financial advice is distributed equally. According to our survey participants, women were more likely than men to receive half of the monetary advice offered. Only 37% of financial advice was equally shared between the sexes.

Looking at the data reveals the biggest difference in advice between men and women when it comes to renting versus buying and closely monitoring spending. Women heard about these topics 29% more often than their male counterparts. More than a fifth of the women had been instructed to set aside a certain amount of money each payday and consider making another appearance to bring in extra cash. Men were 18% less likely than women to be reminded that debts are badly advised.

Money advice can also vary from generation to generation. Like women, baby boomers approaching retirement age often heard that they have more money to set aside than younger generations. The baby boomers also got more advice on other topics – what stood out was that renting is a waste of money and that buying a home is always the right move.

Generation X and most millennials are in their prime working years and are hopefully developing healthy financial habits. The area where Gen X respondents got the most advice was focused on skipping the Starbucks drive-thru window and getting their caffeine solution at home.

Generation Zers received their fair share of advice on the importance of saving early. The money advice that Generation Zers received more than other generations was to forego food and earn an additional income through a second job. Fortunately for them, Gen Zers did additional opportunities to generate additional income more than other generations.

Using existing skills, you can make additional savings or pay off high-interest debt. Learn how to do it Generate income from a current hobby is a different idea.

Advice perceptions

Good advice, often given with the best of intentions, can sometimes go badly.

Seven in ten respondents said they would take out a loan without establishing a repayment strategy that was worst or harmful. The opposite of the “save-your-money” amount sometimes shows up as a distant cousin with the “might as well enjoy it while you can” mentality. It certainly didn’t motivate 57% of those surveyed on the receiving end.

While there is some risk involved in investing, 49% of respondents know that investing properly is not like gambling – despite hearing this poisonous advice.

from 2010 to 2020, the Dow Jones Industrial Average achieved an average return of 10.73%. The lowest return in 2018 was -5.63%, the highest was 26.5% in 2013. Only two of these 11 years brought negative returns. If there is enough time, the market has historically always risen.

Good advice from trusted sources usually goes down well. Almost three-quarters of respondents said some of the most helpful pieces of advice are to save a percentage of each paycheck. For more than half of the respondents, it was also “helpful” to distribute money in a diversified portfolio and start a retirement plan in the first few years of an employee. Millennials were also the generation that most financial advisors thought were “toxic”.

Knowing when and how to take financial advice can be difficult. Respondents who had their finances under control were three times more likely to take “toxic” advice than less financially healthy respondents. The advice that around three-quarters of financially healthy people found best was to diversify investments, save for retirement from an early age, and pay a percentage to the piggy bank each month.

Looking for financial advice

In today’s world of instant information, finding sources you can trust can be a challenge. Relatives and some social websites were preferred as sources of finance by many respondents.

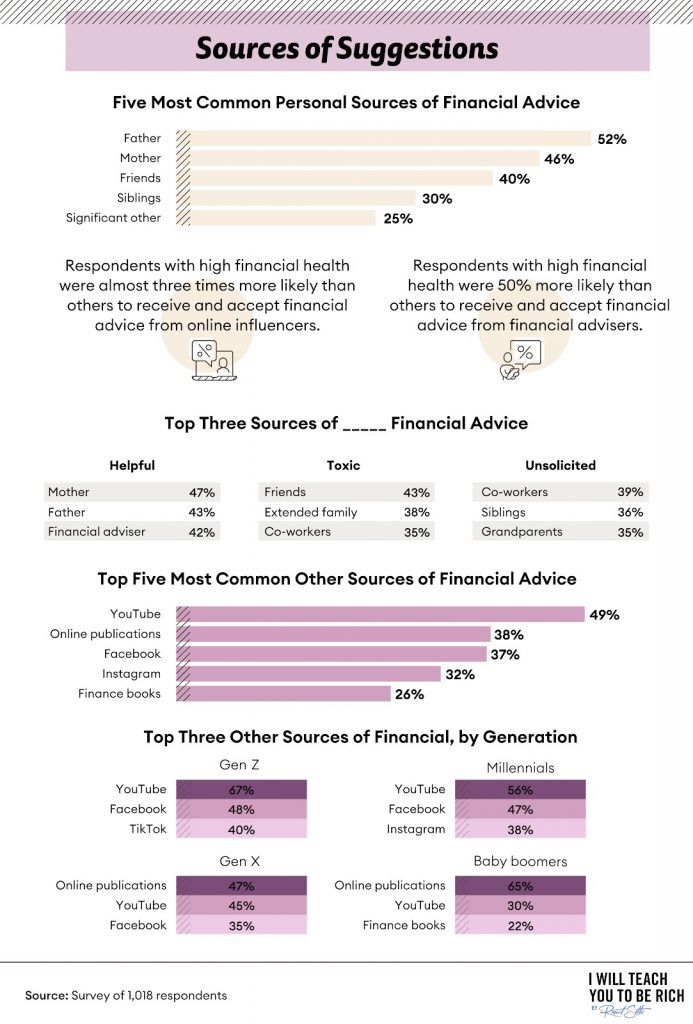

The phrase “father knows best” certainly applies to financial advice to relatives, since dad, 52% of those surveyed, came in with clever words and mom and siblings weren’t too far behind.

However, the prize for the most helpful financial advice went to mom, who was 4 percentage points ahead of dad (47% and 43%, respectively). However, when it came to the top sources for the most toxic money tips, friends, family, and coworkers made up the top three list. There is also unsolicited advice most commonly given to our respondents by colleagues, siblings, and grandparents.

Print materials took a back seat to several online sources when it came to securing financial information. YouTube was the most viewed source for financial advice by almost half of our respondents. Other social media outlets like Facebook and Instagram weren’t far behind.

There were differences from generation to generation when respondents revealed their main sources of finance. The common denominator was YouTube, with Millennials and Gen Zers favoring the video channel the most. And while they agreed on Facebook as their second choice, Millennials and Gen Zers shared on their third preferred source, with the former choosing Instagram and the latter choosing TikTok.

Both baby boomers and Generation X preferred financial advice through online publications, followed by YouTube in second place. However, these two generations differed in their third choice – baby boomers opted for printed books, while Generation X cited Facebook.

Build a financial future today

Investing and acquiring financial knowledge shouldn’t be difficult. Learning the techniques to make you rich is easy, and we’ll help everyone get started. I will teach you to be rich trains people from all walks of life to find financial freedom. Some of our techniques can challenge outdated personal financial advice, and we trust our strategies can prepare you to invest and manage money wisely. You don’t have to give up everything in life; Learn the basics and beyond to apply your own successful financial journey.

Methodology and Limitations

For this analysis, we surveyed 1,018 participants who use the Amazon MTurk platform. Of these respondents, 562 were men, 447 were women, and nine were non-binary. The age range of our respondents was between 18 and 77 years with an average age of 41 years. To ensure a sufficient number of respondents from each generation, survey rates were used that were as follows: Generation Z: 207, Millennials: 302, Generation X: 301, and Baby Boomers: 208.

To ensure accurate answers, all respondents had to identify and correctly answer an attention test question. In some cases, the questions and answers have been rephrased for clarity or brevity. This data is self-reported, and potential problems with self-reported data include telescoping, selective memory, and exaggeration.

Fair Use Statement

Not everyone wants to divulge financial secrets, but passing this article on is perfectly fine. All we ask is that you share and link back on the article for non-commercial purposes only to get reasonable credit.

100% privacy. No games, no OS, no spam. When you register, we will keep you up to date