No products in the cart.

Niche Marketing

Primer Sequence: THOR Industries – A Main Participant In A Area of interest, Worthwhile Industry (THO)

Anetlanda

This article is part of an ongoing primer series on great and undercovered companies at attractive valuations. These pieces will provide in-depth analysis of business models, financials and valuations.

THOR Industries (NYSE:THO) is the leading US manufacturer of recreational vehicles (RVs). The company was founded back in 1980 and, since then, it has grown into the largest RV manufacturer in the US and worldwide, with dominant positions both in the motorized and the towable market. After being seen as a clear pandemic beneficiary due to the inability of many Americans to travel abroad, THOR’s stock has abruptly fallen over the last year. The stock price is below its pre-pandemic levels of 2019, even though THOR has kept compounding value during these years, being a more valuable company now than back then.

Before going into the details, there are some noteworthy points to keep in mind:

- The RV industry is a niche, cyclical market with a stable oligopolistic structure, a long and consistent track-record of solid value creation for shareholders, and virtually no competition from abroad.

- The RV manufacturing process is not highly automated, so economies of scale from higher production levels are modest at best. However, size helps when dealing with dealers and suppliers and establishing best practices.

- THOR has leading positions both in the US towable and motorized segment, with market shares in 2022 of 42% and 49.4%, respectively. THOR also commands a leading position in the European market thanks to the acquisition of Erwin Hymer Group (EHG) back in 2019. The European market is much more fragmented than the US one, and it could be a source of future growth for THOR.

- THOR has a solid balance sheet and an attractive shareholder remuneration program, comprised of a growing dividend and a share buyback authorization of $450M (9% of current market cap).

- THOR’s valuation is pretty undemanding. At $90 per share, the company has an EV of roughly $6.3bn., which implies EV/NOA’22 and EV/NOI’22 multiples of 1.2x and 6.5x, respectively.[1] On a levered basis, THOR sports a 1.3x P/BV and a 5.3x P/E’22. Given that THOR’s average return on net operating assets (RNOA) has been around 20.6% over the last decade (ROE of 19.1%), and that it has been growing economic earnings (earnings after the cost of capital) at a healthy clip, the level of discount is unwarranted in my view.[2] An 8% (EV) discount rate and a 2% growth rate in residual earnings, assuming much lower future RNOAs (14%), would yield a target price of $160, implying equity returns of 13% at perpetuity.

THOR’s history

THOR Industries was founded back in 1980 by Wade Thompson and Peter Orthwein, who acquired the Airstream division of Beatrice Foods, a poorly run conglomerate that was suffering from the economic crisis of the 1970s and was hemorrhaging money. Airstream was quickly turned around (from a loss of $12M to a profit of $1M after one year of operation) and served as the platform for many more acquisitions during the following two decades. The company was named THOR after the surnames of its two founders.

THOR IPOed in 1984, and in 2001 it closed the acquisition of Keystone, a travel trailer and fifth wheel manufacturer that made THOR the largest manufacturer in the US with a 25% market share at the time. In parallel, THOR built a bus manufacturing business from scratch during the 1980s and 1990s with the acquisitions of General Coach, ElDorado and Champion Bus. The bus manufacturing business was later sold in 2013 to a subsidiary of Forest River, due to its inferior economics versus the RV business and the lack of synergies between them.

The Global Financial Crisis was a tough time for the industry overall, but THOR’s better economics than competitors (THOR has not posted a loss over the last three decades, which is quite remarkable) and its debt-free balance sheet allowed it to buy several companies during the following decade, increasing its market share along the way. Notable acquisitions were as follows:

- 2014: K-Z, an Indiana-based manufacturer, specialised in travel trailers. K-Z had $150M in revenues and the purchase price was $53M.

- 2015: Cruiser RV and DRV, Indiana-based manufacturers of towables and luxury fifth wheel RVs, respectively. They had $135M in revenues, and the purchase price was $47M.

- 2015: Postle Aluminum, an Indiana-based manufacturer of aluminium extrusions and powder coating and painting services. The company had $220M in revenues, and the purchase price was $144M. This was THOR’s first important acquisition in components.

- 2016: this year was momentous for the company, as it acquired Jaico Corp., a manufacturer of RV vehicles, from travel trailers to Class A and C motorhomes, with iconic brands such as Starcraft RV, Highland Ridge and Entegra Coach. Jaico had $1.5bn. of revenues in 2015, EBT of $70M and the purchase price was $576M.

- 2018: this year saw THOR’s largest acquisition ever, Erwin Hymer Group (EHG), one of the largest RV manufacturers in Europe. EHG had revenues of €2.5bn and the purchase price was €2.1bn. Transaction was closed in February ’19. The acquisition allowed THOR gaining a foothold for the first time in the European market (second position with a 26% market share in motorhomes back then).

- 2020: Tiffin Group, a manufacturer of luxury RVs, with a leading presence in the luxury Class A and C market through the Allegro and Wayfarer brands. Tiffin was a family-owned business that was founded in 1972, with operations in Alabama and Mississippi. Tiffin’s revenues were $800M in 2019 and the purchase price was $300M. Tiffin also had subsidiaries that manufacture windows, furniture, doors and fiberglass.

- 2021: Airxcel, a Kansas-based manufacturer of RV products such as rooftop air conditioners, heat pumps, thermostats, water heaters, cooking appliances and roofing products, sealants, and coatings. Airxcel’s expected revenues for 2021 were $680M (EBITDA of $86M), and the purchase price was $750M (7.6x EBITDA). Approximately 80% of Airxcel’s revenues were from OEM sales with the remaining 20% from aftermarket sales.

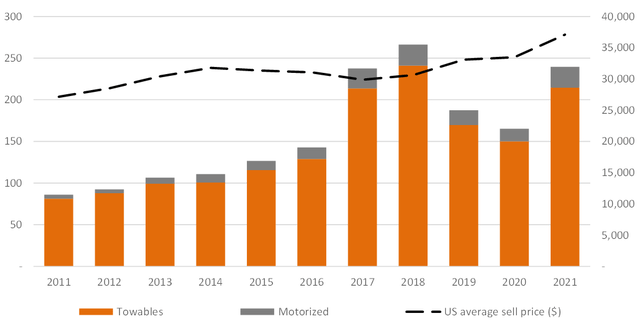

After such a string of acquisitions, it is no wonder that THOR’s total production volumes have increased over the last decade, outpacing industry gains, from 86k units in 2011 to 268k, the record in the company’s history:

Source: THOR Industries filings and own elaboration. Units sold in thousands, prices in dollars in the right-hand axis

What can we learn about THOR’s acquisition strategy?

First, one common denominator of all these acquisitions is that THOR leaves the management team in place, operating thus in a very decentralised manner. Many of these businesses were private and family-owned, and they see THOR as a natural pathway to monetization but at the same time keeping the involvement in the business. THOR mainly provides help in terms of sourcing components and raw materials, logistics, and marketing and distribution.

Second, the transactions have been carried out at attractive valuations, especially before 2018. With the exception of EHG, which focuses on a different geography, all acquisitions have made strategic sense, as they have levered THOR’s production, distribution, and logistics capabilities in the US. If I had to say my only complaint about the M&A policy so far, probably it would be about the acquisition of EHG. Valuation was relatively high, synergies from the deal were small and, finally, it is fair to say that the European market is somehow inferior to the US one. Although the reasons are not widely discussed, I suspect that the higher share of motorized units versus towables in Europe makes this market to be less profitable. Although in terms of gross margins EHG has been similar to the US motorized segment (with gross margins between 10% and 14%), the US towable segment has been more profitable in this regard (with gross margins between 13% and 17%). Although I will discuss later some other important aspects of the European business, it is also worth mentioning that the capital intensity of the motorized segment is slightly larger than for the towable one, creating a larger gap between the returns on capital of both segments.

Finally, it is very unlikely that THOR will engage in such an expansionary M&A policy in the future. It already commands high market shares, and additional purchases would bring antitrust oversight. With that avenue of growth closed, the two most likely avenues are further acquisitions in other markets (especially in Europe) and additional (but small) upstream acquisitions in the US.

Some observations on the RV industry

It is well known that the RV industry is cyclical, for the simple fact that RVs are a discretionary product with a high price tag.

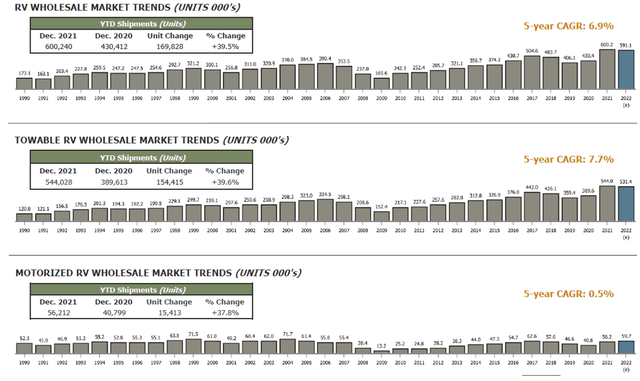

The industry has been a beneficiary of the pandemic (work from anywhere, inability to travel abroad, etc.), with total sold units of 600k in 2021, a historical record, and well above the 504k units sold in the previous cycle (2017). Most of the market is comprised of towable units, which were 531k in 2021, almost ten times the number of motorized units sold (59.7k). As portrayed in the following graph, the towable segment is much larger than what it was before the GFC, but the motorized one has not reached the peak of 2004 yet:

Source: THOR Industries 2Q’22 Results Presentation.

In terms of demand, and according to the RV Industry Association (RVIA), RV ownership has increased 62% over the last 20 years to a record 11.2M households. A large portion of this growth has been driven by younger generations (millennials and Gen Z), who now make up 22% of the market. RVIA estimates that 9.6M households intend to buy an RV within the next five years, with 84% of current owners aged 18-34 years old planning to buy another RV. Nearly one-third of respondents to the RVIA survey were first-time owners, demonstrating the recent pickup in RV interest. Although demand trends have been encouraging recently, the present investment thesis does not assume a continuation of recent numbers; it will also work if overall demand levels fall back to the 400k range per year, given the flexible nature of THOR’s cost structure across the cycle – for reasons discussed below.

It must be mentioned that other trends, such as ride-sharing services (e.g., RVShares and Outdoorsy) or a growing used RV market,[1] could sustain higher levels of demand in the future, but again, none of this is included in the valuation analysis below.

In terms of supply, the picture is much clearer. As mentioned above, the consolidation that occurred during the 2010s has left a highly consolidated industry with rational players. As of the end of 2021, THOR had a market share of 40.8% in the towable market, whereas Forest River had 36.6%, Grand Design 10%, and the rest of the players less than 2% each. In the motorized market, the concentration is even higher (for reasons explained below), with THOR controlling 47.7%, Forest River at 18.2%, and Winnebago at 19.7%.[2]

It is worth remembering that Forest River has been controlled by Berkshire Hathaway for 17 years, which is no doubt a rational competitor (if Forest River does not find compelling investment opportunities it sends the cash up to Omaha) and provides some validation that industry economics are good. As THOR mentioned in its 2Q’22 results, THOR has not elected to chase further market share, being more focused on margins.

In any case, the RV industry has been quite profitable over the economic cycle. What are the main reasons behind the profitability of the industry? I would mention the following points:

- Unlike the manufacturing process in the light vehicle industry, the RV manufacturing process has always been much more manual, for two reasons. First, RV OEMs make many little changes to their products every year, as the need for differentiation is high, and overall industry production volumes are much lower than in the auto industry. Second, RV OEMs have stayed away from automation due to the cyclical nature of the business and the need to keep the fixed part of the cost structure as small as possible in order to survive in a downturn.

- The high degree of manual processes means that for the OEMs there is little incentive to consolidate their various brands: cost advantages from efficiency would be low. Different brands are sold in different states, the products tend to be different across brands (appealing to the particularities of a certain region), and the relationship with dealers is sometimes based on brand exclusivity.

- The motorized and towable segments are different, not only in terms of the final client and price points (motorized units being much more expensive), but also in their economics. Towables are relatively easier to penetrate by potential new competitors. Motorized units are more challenging, in terms of engineering design and the need to have “deep pockets” to finance the different parts.

- Relationships are one of the most important (and often underappreciated) barriers to entry into the industry, being the result of how localised the production is. Around 80% of the RVs manufactured in North America come from Indiana. RV suppliers are also mainly located in Indiana given the just-in-time inventories with which the OEMs operate. From a cost perspective, and given how manual the manufacturing process is, it is important to remember that Indiana also has lower living costs versus the rest of the US.

- Since the EHG acquisition, THOR also has exposure to the European market, which has its own particularities. The key difference is that the US market is dominated by trailers, whereas the European one has traditionally been a motorized market (due to historical reasons, but also due to traffic restrictions in urban areas). Trailers usually command higher gross profits, and therefore THOR’s overall US business delivers better gross margins than the European one. The main reason for this difference in profitability lies in the value of the chassis, which is higher in a motorized unit, and the value goes to the OEM given that it provides “more pieces”.

Valuation

After being seen as a clear pandemic beneficiary due to the inability of many Americans to travel abroad, THOR’s stock has fallen due to concerns about the economic cycle, oil prices, and the general market disdain for Covid winners. The stock price is back to its pre-pandemic levels of 2019, although THOR has kept compounding value during these years, as I have shown in the history section.

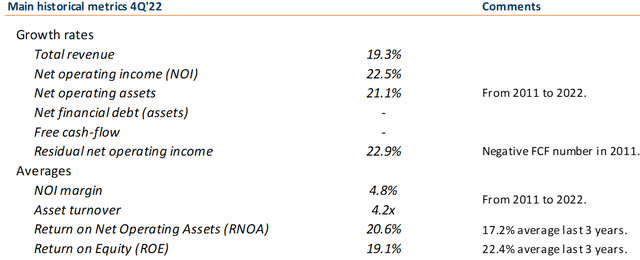

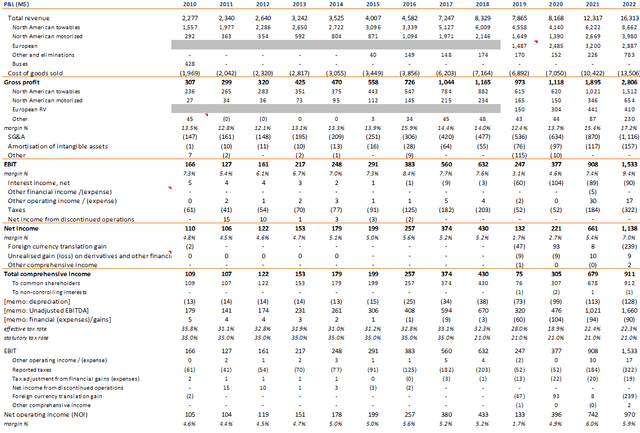

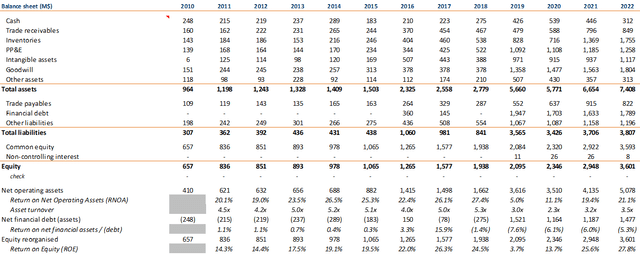

THOR’s historical financial statements are presented in detail at the end of the article. I have also reorganised the accounts to give a clear view of the operating and financial activities. In order to frame the inputs of the valuation, the following table gives a nice sketch of what the company has delivered since 2011:

Source: THOR Industries filings and own elaboration.

From 2011 until 2022, THOR has grown revenues at 18% CAGR, whereas net operating assets have been growing at 21%. Although revenues have been greatly helped by the countless acquisitions described above, it is reassuring to see that NOAs have grown broadly in line, suggesting that THOR has not overpaid for its acquisitions (with the possible exception of EHG) and that the turnover of the business has remained largely stable. Overall, the company has earned an average RNOA of 20.6% since 2011, driven by a 4.8% margin and an asset turnover of 4.2x.

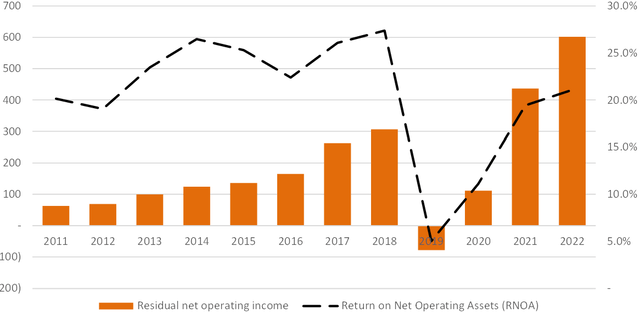

As I mentioned above, it is worth repeating that the business has delivered consistent returns on capital over time despite its apparent cyclicality. Except for 2019, which saw a downturn in the RV industry, THOR has generated positive returns above its cost of capital (assuming an 8% threshold rate) over the last decade. On top of that, the stream of economic profits has also kept growing as more capital has been deployed into the business through acquisitions:

Source: THOR Industries filings and own elaboration. Numbers in millions. Rate of discount assumed: 8%.

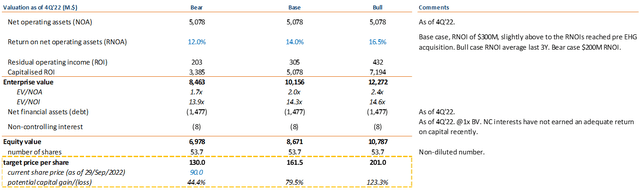

These metrics can give us a valuation range for the business. For an (EV) discount rate of 8%, a growth rate in residual earnings of 2%, and a return on net operating assets of 14% (or $300M of economic profits annually) on its asset base of $5bn., the EV would be around $10.1bn., implying an 80% upside, or $160 per share. At that price, THOR would trade at 2x EV/NOA and 14.4x EV/NOI. It must be stressed that I regard a 14% rate of return as a very conservative assumption over the long term, given THOR’s track record, the maturity of the industry and the trends discussed above.

On the other hand, if we assume economic profits of $200M (the average from 2017 to 2021), the target price would drop to $130 per share – which means that the margin of safety is ample:

Source: THOR Industries filings and own elaboration. Numbers in millions. Rate of discount assumed: 8%. Growth rate assumed: 2%.

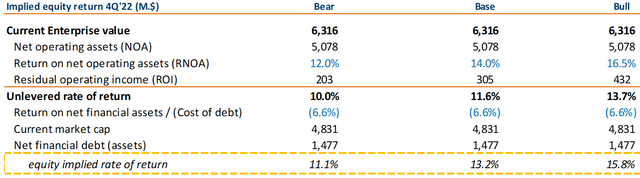

There is another useful way to frame the current valuation discount: in terms of internal rates of return. Given the current EV of $6.3bn. (EV/NOA of 1.2x), and assuming that our forward RNOAs are correct (12% for the bear case, 15% for the base case, and 18% for the bull case), future unlevered returns will annualise 10%, 11.6%, and 14%, respectively; which after taking into account the modest leverage of the company, will rise to 11%, 13%, and 16%, offering thus strong return prospects for long-term investors:

Source: THOR Industries filings and own elaboration.

Other qualitative considerations

Regarding capital allocation, it is important to mention that THOR’s management team has a long-term approach when managing the business. Historically, the business ran with little or no debt, as one of the founding partners did not like the risks that debt brought to this business. Recently, due to the acquisitions of EHG and Airxcel the company has some debt on its balance sheet, but management has guided to a leverage ratio of less than 1x EBITDA for the foreseeable future – they still have to some extent a no-debt mentality. On the other hand, they are committed to a growing dividend and to opportunistic share buybacks: they approved a $450M authorization recently, 9% of the current market cap.

Peter Orthwein is still a significant shareholder with a 3.5% stake (he is also Chairman Emeritus), but unfortunately, the management team does not own a significant stake in the business. Compensation is mostly variable and largely linked to the evolution of the following basket: profits before tax, ROIC, and FCF. Finally, it is worth mentioning that the company does not conduct quarterly conference calls, but rather relies on a Q&A document published together with the results, a quite heterodox way to provide information considering the standards of most listed companies. I view this way of communicating results in a highly favourable way, and which has coincidentally been used by some other extraordinary companies (Expeditors International of Washington comes to mind).

Downside risks

- The RV-component industry has become increasingly consolidated over time, thanks mainly to the efforts of LCI and Patrick Industries. Although the relationship between the OEMs and their suppliers is very close and has been good so far, further consolidation could erode THOR’s bargaining position.

- The dealer space is highly fragmented at the moment, but there is a wave of consolidation going on (led by RV Retailer and Camping World), which could impact THOR’s negotiating leverage over the long term.

- On a longer-term basis, the rise of autonomous vehicles may bring interest (and potential competition) from auto OEMs into the RV sector, as people may prefer larger autos when taking longer trips (which, I would argue, will be more frequent, given the convenience of autonomous driving).

Upside opportunities

- The economic cycle is not as bad as it is feared.

- Future share repurchases are carried out at current or more attractive levels.

- THOR makes further moves to consolidate the European industry at attractive valuations.

- Additional upstream acquisitions (i.e., components) at attractive valuations.

Appendix I: THOR Industries reorganised financial statements (2010-2022)

Reorganised income statement

Source: THOR Industries filings and own elaboration.

Reorganised balance sheet

Source: THOR Industries filings and own elaboration.

[1] According to THOR, used RV sales are a complement to the new RV market since the used-RV buyer generally follows the same historical 3- to 5-year trade-in, trade-up cycle, adding to potential new RV sales in the long-term. On the other hand, there is a healthy percentage of potential buyers who prefer trying before buying.

[2] Back in 2012, THOR’s market share in trailers was 38% and 21% in motorhomes. See THOR’s 10K’12, p.6.

[1] EV/NOA: Enterprise value to net operating assets. EV/NOI: Enterprise value to net operating income. Net operating assets are computed as equity (including minority interests) plus net financial debt. Net operating income is computed as EBIT after statutory taxes, less other comprehensive income operating items (such as currency translation adjustments). EV/NOA and EV/NOI, are, in effect, the unlevered measures of P/BV, and P/E, respectively.

[2] Return on net operating assets (RNOA): net operating income divided by net operating assets.