No products in the cart.

Niche Marketing

Veeva: Area of interest SaaS Does not Hit The Mark For Me (NYSE:VEEV)

everythingpossible/iStock via Getty Images

As I continue my foray into the cloud sector, companies like Veeva (NYSE:VEEV) and nCino (NYSE:NCNO) have really stuck out to me. These are smaller cloud companies that have carved out a niche insulating them from competitors within their respective operating areas.

Although VEEV is an interesting company, the risks outweigh the potential rewards for investment here, despite the drawdown. Too many other companies across the beaten down stock market offer better value propositions today, despite the fact I’m sure VEEV’s stock price will do just fine once the market rebounds.

The Business

VEEV operates as a cloud software company specifically tailored to the life sciences industry. Its principal product is a CRM offering built on Salesforce’s (NYSE:CRM) platform. The company’s focus allows it to be well-attuned to customer needs in the highly regulated market that it serves, leading to a wide moat. VEEV serves nine out of the top 10 global pharmaceutical companies, estimates an 80% market share in life sciences CRM, and has boasted a 119% retention rate, thus growing revenues above and beyond any churn in its subscriptions. Since its launch in 2007, the company has successfully branched out with the launch of its Vault product, which manages clinical trial and regulatory data which used to be disparately maintained by many companies across several platforms. The platform has been successful enough that six out of the top seven top contract research organizations use it, which drives a similar effect to that seen in Microsoft (NYSE:MSFT) and Adobe (NYSE:ADBE), where the largest software company in the space effectively becomes the standard for the smaller companies and drives their adoption.

Among the company’s customers, VEEV has driven a similar effect of land-and-expand as seen throughout the space, with the average commercial cloud [CRM] subscriber using 2.52 products, and the average Research Cloud (Vault among others) subscriber using 3.72 products. This type of adoption is incredibly sticky, and even moreso in the life sciences space, as customers could lose data, face regulatory risk, and more on top of the lost productivity by switching providers or building a solution in-house.

An interesting wrinkle specific to VEEV is its transition to a public benefit corporation. I’ll just use the words from the 10-Q to describe it below:

On February 1, 2021, we became a Delaware public benefit corporation (PBC), and we amended our certificate of incorporation to include the following public benefit purpose: “to provide products and services that are intended to help make the industries we serve more productive, and to create high-quality employment opportunities in the communities in which we operate.” When making decisions, our directors have a fiduciary duty to balance the financial interests of stockholders, the best interests of other stakeholders materially affected by our conduct (including customers, employees, partners, and the communities in which we operate), and the pursuit of our public benefit purpose.

This isn’t a deal breaker for me, but I’m not really a fan. The company discusses the broad shareholder voting support it received when proposing the transition, which isn’t surprising considering the tech-standard dual share class voting structure placing nearly all the voting power into select hands. As a potential investor, seeing a company transition to removing shareholders as the primary benefactor of business operations is a strong statement, and one I’d just rather avoid, when possible.

Slowing Growth

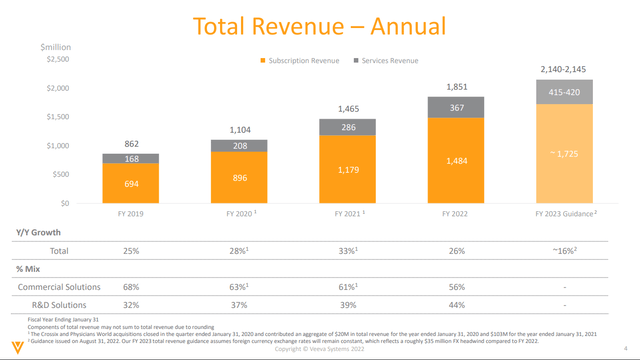

Company presentation

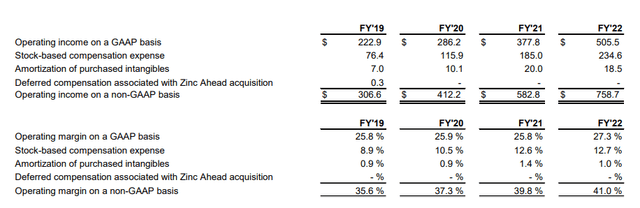

In the most recent quarter, the company reduced future guidance by 1.5%, and revenue growth slowed to 16%. The company’s client base is relatively insulated, being in the healthcare field, but among its customers, approximately 60% are larger companies and 40% are small or medium businesses, some even pre-revenue. With growth slowing, the obvious fear is market saturation. VEEV has done well in landing and expanding, but the pond is only so big and this is a very real concern for investors. Growth may rebound, but one of the options in front of management is expanding beyond life sciences, which would prove very difficult for the company very quickly based on its agreement with CRM and the increased competition that type of move brings. Specifically, I am not a lawyer, but the agreement allows VEEV to use the CRM platform as part of its business, CRM won’t build a competing product, but VEEV wouldn’t have to travel far outside of life sciences to run into CRM as a competitor vice technology provider.

Overall, the metrics for the company look good despite the slowing growth. Gross margins continue to expand, and we are still looking at a high teens percent revenue growth rate and a profitable company.

Company presentation

Risks to the Company

As I stated above, VEEV is heavily reliant on the CRM platform. I’ll just copy the risk from the 10-K below:

Because key and substantial portions of our multichannel CRM applications are built on salesforce.com’s Salesforce Platform, we are dependent upon salesforce.com to provide these solutions to our customers and we are bound by the restrictions of our agreement with salesforce.com, which limits the markets to which we may sell our Veeva CRM solution.

I don’t see this as a significant risk for the company, as there is precedent and the agreement appears to have been amicable thus far.

Another risk I think worth highlighting is customer concentration. Although the company boasts 1200 customers, 31% of revenue is derived from the top 10 customers. It’s worth noting, but I wouldn’t lose sleep over it as an investor. These software solutions are very sticky and it’s unlikely to see one of these large pharma companies switching and incurring unnecessary operational risk.

Finally, VEEV has been engaged in back-and-forth litigation with one of its only true competitors, IQVIA, which has built a similar CRM offering on the Salesforce platform and competes with VEEV in providing prescription drug sales data. They’ve outlined the basics of it below from the 10-Q:

In the complaint, IQVIA alleges that we used unauthorized access to proprietary IQVIA data to improve our software and data products and that our software is designed to steal IQVIA trade secrets. IQVIA further alleges that we have intentionally gained unauthorized access to IQVIA proprietary information to gain an unfair advantage in marketing our products and that we have made false statements concerning IQVIA’s conduct and our data security capabilities.

Our counterclaims allege that IQVIA, as the dominant provider of data for life sciences companies, has abused monopoly power to exclude Veeva OpenData and Veeva Network from their respective markets. The counterclaims allege that IQVIA has engaged in various tactics to prevent customers from using our applications and has deliberately raised costs and increased the difficulty of attempting to switch from IQVIA data to our data products.

It’s not perfectly clear what the consequences could be from this litigation. The company outlined that a loss of use for its customers of IQVIA data could make its products less desirable and negatively impact the business. I don’t see a game changing problem here, but it’s worth keeping an eye on.

Valuation

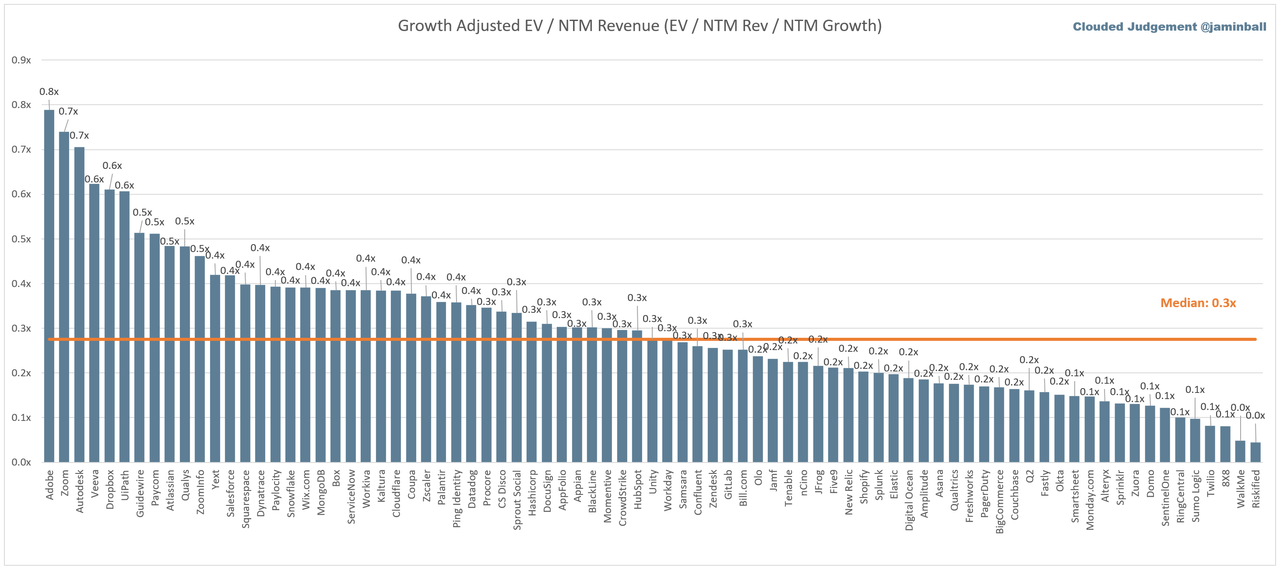

Clouded Judgement Substack

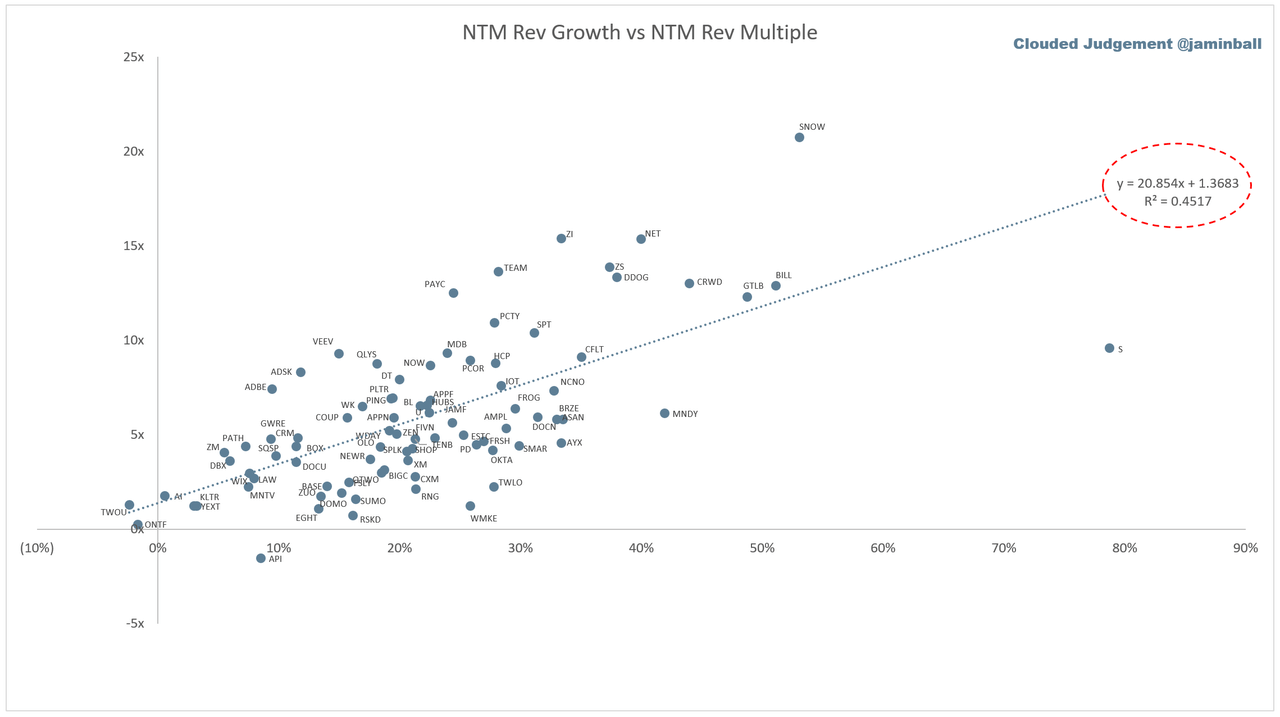

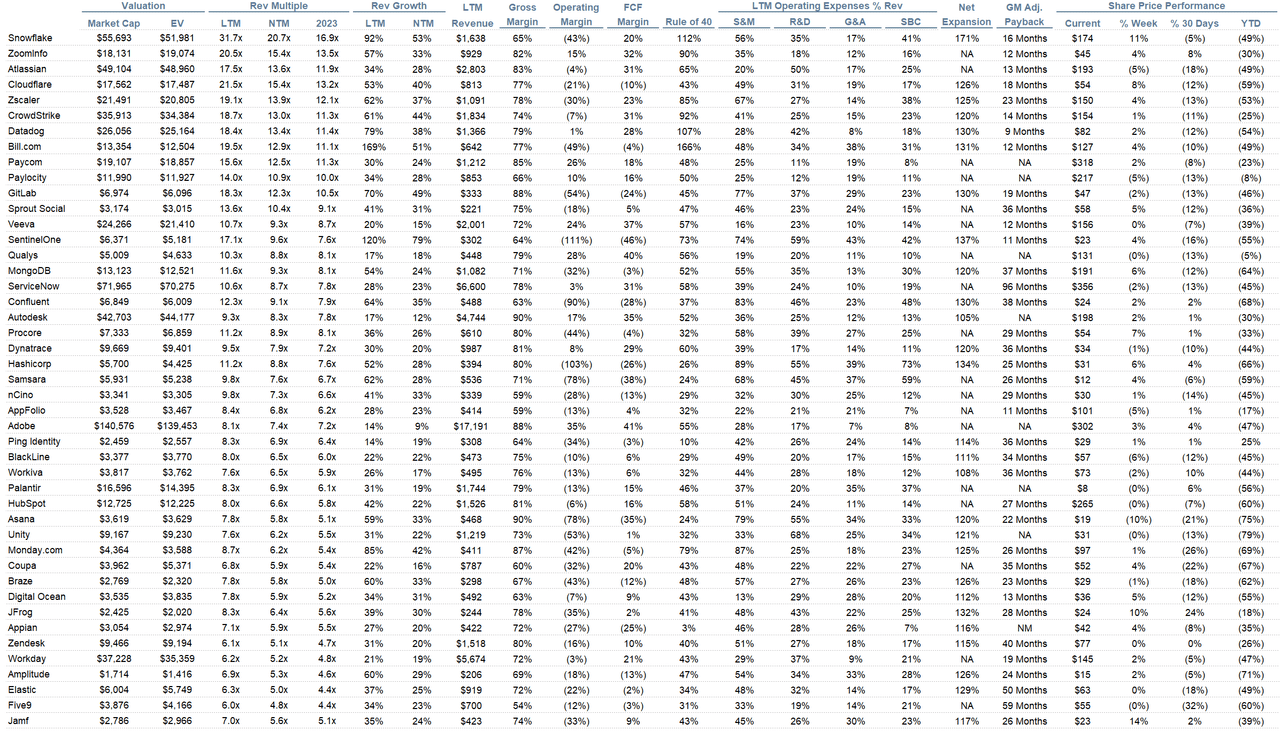

Moving over to valuation, I’m going to use a few graphs from Jamin Ball’s Clouded Judgement Substack, where he has compiled relevant statistics from across the cloud software landscape. VEEV falls in the upper echelon above at 9X EV/NTM (next twelve months) revenue. Another visualization below shows that VEEV is amongst the most expensive when factoring in its growth rate among the cloud software companies. A premium multiple is justified in some ways based on the stickiness and reliability of its revenues and the company’s profitability, but with growth slowing, I’m not convinced VEEV should be sitting where it is on that graph.

Clouded Judgement Substack

Looking below, VEEV comfortably laps the rule-of-40 at 57%, which is a measure of revenue growth rate added to free cash flow margin, and being profitable, that puts it in a tier of its own among cloud companies with a positive operating margin. The company is more mature than many of these names despite its size, since it was founded in 2007 and boasts a significant market penetration in its sector.

Clouded Judgement Substack

Stock Based Compensation and Balance Sheet

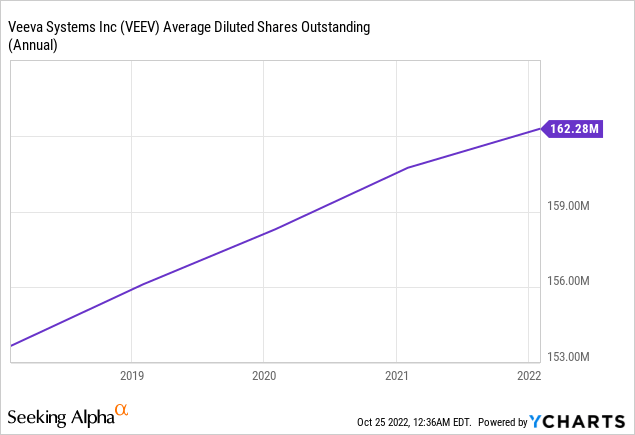

Data by YCharts

Data by YCharts

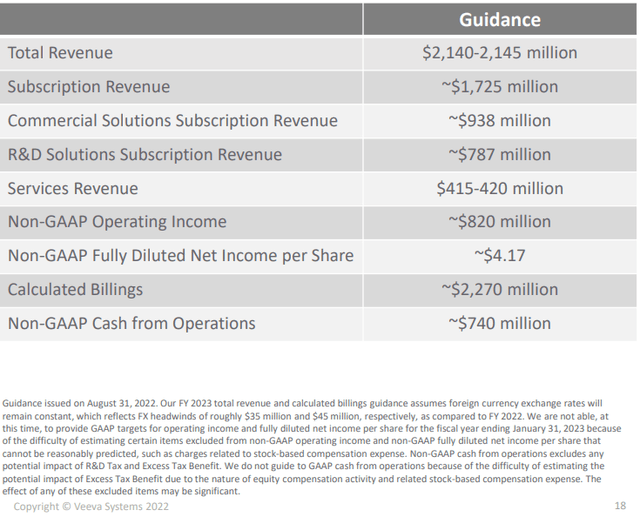

Everyone’s favorite topic is share-based compensation. VEEV isn’t out of the box here compared to peers at first glance. Although the share count is most definitely rising, SBC accounted for 14% of revenues, compared to 41% for a company like Snowflake (NSYE:SNOW). However, the insidious thing here is shown below, from the 10-Q. Notice GAAP operating income being adjusted for an ever increasing SBC value. In 2022, the company raised its non-GAAP operating income value by 46% for SBC. SBC is not a charge that needs to be adjusted for. It’s recurring, and based on its 10-K, it’s part of the compensation structure promised to employees. Therefore, it’s a cost of doing business, but operating margins are adjusted by 12% and the inflated operating income do a disservice to potential investors in showing how profitable the company is. VEEV is not the only perpetrator here, this is standard practice in tech these days. Make sure you are reading these companies regulatory filings.

The company is currently sitting on $3.4B in cash with no debt, so no concerns there and the company is generating sufficient cash flows to invest in future growth.

10-K

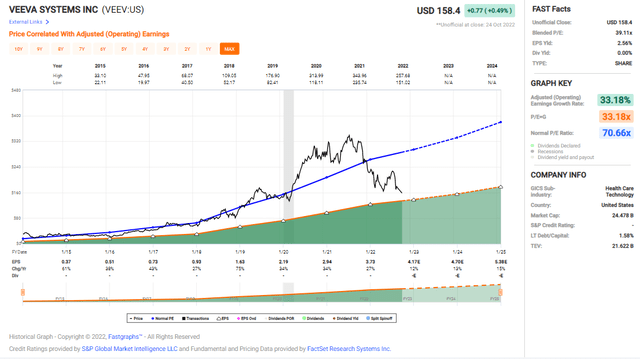

FAST Graphs

Looking at the graph above, the company has come back down to earth following its run-up with the rest of tech post-COVID. Earnings growth looks steady which is no surprise considering the company’s revenues are almost entirely recurring. As the company approaches its multiple nearly in-line with its earnings growth rate, it looks to be about as cheap as it has been since entering this stage of growth.

However, my opinion after digging in here is that there are better options out there with fewer question marks. If I’m going to pay around 40X earnings for a business, I don’t want to have as many concerns as I do about how the company will continue to manage its growth. I think VEEV deserves a further discount, but really I’ll just be watching for a further reacceleration in revenue growth. When and if that occurs, I’m sure I’ll be paying more for the company, but it will be an easier pill to swallow.